DailyPlay – Opening Trade (NVDA) – December 03, 2025

NVDA Bullish Opening Trade Signal Investment Rationale...

Read MoreDailyPlay Portfolio Review

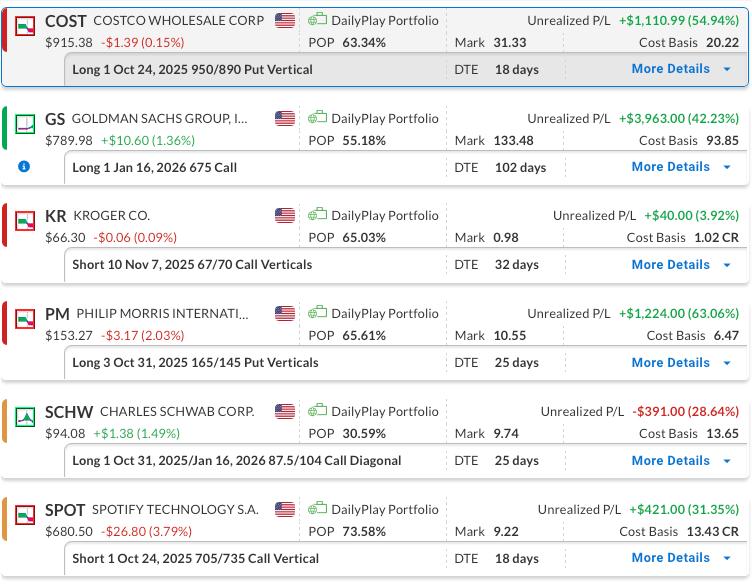

Our Trades

COST – 18 DTE

Bearish Debit Spread – Costco Wholesale Corporation (COST) – The position remains profitable, with continued downside momentum last week driven by a mixed consumer environment and renewed tariff concerns. We plan to maintain the position for now.

GS – 102 DTE

Bullish Diagonal Debit Spread – Goldman Sachs Group, Inc. (GS) – We maintain a longer-term bullish outlook and plan to continue holding this position. To reduce the cost basis, we sold a short-term out-of-the-money call that expired last week, and the setup remains favorable.

KR – 32 DTE

Bearish Credit Spread – The Kroger Co. (KR) – We recently established this position and we plan to stay the course for now.

PM – 25 DTE

Bearish Put Debit Spread – Philip Morris International Inc. (PM) – This newly opened and profitable position continued to trend lower last week, reinforcing our bearish outlook. We plan to keep the position in place for now.

SCHW – 25 DTE & 102 DTE

Bullish Diagonal Debit Spread – Charles Schwab Corp. (SCHW) – The outlook remains unchanged from last week. We continue to hold a bullish view on Schwab. After realizing gains from our initial long call, we rolled into a higher strike call with a later expiration. To reduce the cost basis, we recently sold a short-term OTM call against the long position.

SPOT – 18 DTE

Bearish Credit Spread – Spotify Technology (SPOT) – We recently established this position, and it is currently showing a gain. Bearish momentum is building, and with plenty of time until expiration, we plan to stay the course for now.

NVDA Bullish Opening Trade Signal Investment Rationale...

Read More

META Bullish Trade Adjustment Signal Investment...

Read More

DailyPlay Portfolio Review Our Trades FDX – 32 DTE...

Read More

Share this on