DailyPlay – Portfolio Review – November 24, 2025

DailyPlay Portfolio Review Our Trades LMT – 11 DTE...

Read MoreStrategy: Long Call Vertical Spread

Direction: Bullish

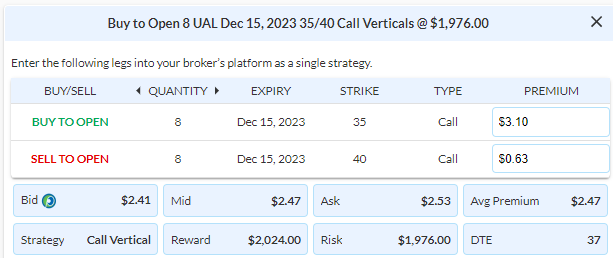

Details: Buy to Open 8 Contracts Dec 15th $35/$40 Call Vertical Spreads @ $2.47 Debit per contract.

Total Risk: This trade has a max risk of $1,976 (8 Contracts x $247) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $247 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is neutral to bearish, but expected to break out higher.

1M/6M Trends: Neutral/ Bearish

Relative Strength: 3/10

OptionsPlay Score: 90

Stop Loss: @ $1.25 Credit. (50% loss on premium paid)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Equity markets have paused just below the $4420 major resistance level at the moment. If we see a break above that level, the next upside target is $4565. We have a few positions that require adjusting based on the risk of a significant breakout higher. AAPL despite missing earnings has failed to follow through with a selloff and remains at a rich valuation. We must close out this trade at this point and manage our other positions. One of our positions that is best poised for a breakout higher in the markets is our UAL position. We have already added to this position and have another opportunity to add one last part before it can rally to our $40 upside target. I’m looking to add another 8 contracts of the Dec $35/40 Call Vertical @ $2.47 Debit. This would risk another 2% of our hypothetical portfolio of $100,000. We will also move our stop loss on the call spread to around 50% of the premium paid @ $1.25 Credit on the full 31 contracts.

DailyPlay Portfolio Review Our Trades LMT – 11 DTE...

Read More

Closing Trade META Bullish Opening Trade Signal Investment...

Read More

Share this on