DailyPlay – Adjusting Trade (SCHW) – October 24, 2025

SCHW Bullish Trade Adjustment Signal

Investment Rationale

Adjustment Rationale:

Charles Schwab Corp. (SCHW) – Last Thursday, October 16th, Schwab reported earnings that exceeded both revenue and profit expectations. We remain bullish on the stock. After realizing gains on our initial long call, we rolled into a higher strike with a longer expiration, then sold a short-term out-of-the-money call to lower our cost basis.

Our next adjustment involves closing the existing short leg and selling to open another call with a lower strike and later expiration, generating a net credit. This will further reduce the cost basis of our long option position. The current position and proposed adjustment are detailed below.

Current Position:

- Long 1 SCHW Jan 16, 2026 87.5 Call

- Short 1 SCHW Oct 31, 2025 104 Call

Adjustment – Roll:

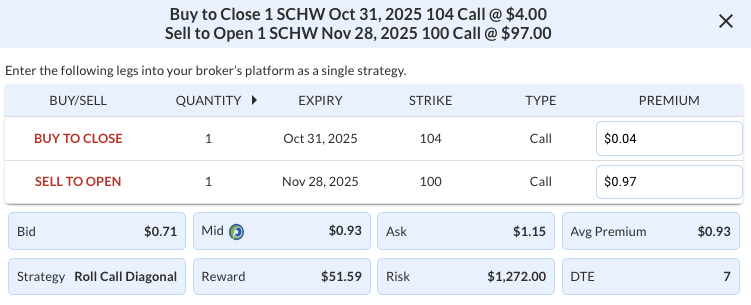

Sell to Open 1 Nov 28, 2025 100 Call $0.97

Buy to Close 1 Oct 31, 2025 104 Call $0.04

Resulting Position:

Long 1 SCHW Jan 16, 2026 87.5 Call

Short 1 SCHW Nov 28, 2025 100 Call

New cost Basis and total risk of $1,272

SCHW – Daily

Trade Details

Strategy Details

Strategy: Rolling a Short Call option down and out

Direction: Resulting in a new Bullish Diagonal Spread

Details: Buy to Close 1 SCHW Oct 31 $104 Call and Sell to Open 1 SCHW Nov 28 $100 Call @ $0.93 Net Credit.

Total Risk: The resulting position has a maximum risk of $1,272 (1,365-93), calculated as the initial cost basis of the trade ($1,365) minus the premium received from the adjustment ($93).

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of the trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 7/10

Stop Loss: @ $6.36 (50% loss of premium)

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

More DailyPlay

DailyPlay – Opening Trade (FDX) & Closing Trade (LMT) – November 25, 2025

Closing Trade FDX Bullish Opening Trade Signal Investment...

Read More

DailyPlay – Portfolio Review – November 24, 2025

DailyPlay Portfolio Review Our Trades LMT – 11 DTE...

Read More

DailyPlay – Opening Trade (META) & Closing Trade (WMT) – November 21, 2025

Closing Trade META Bullish Opening Trade Signal Investment...

Read More

Share this on