DailyPlay – Portfolio Review – August 11, 2025

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read MoreAAPL – 144.90% Loss: Buy to Close 3 Contracts Aug 26, 2022 $155/$165 Call Verticals @ $9.60 Debit. DailyPlay Portfolio: By closing all 3 Contracts, we will be paying $2,880.

HD – 60.19% Loss: Sell to Close 3 Contracts Sept 16, 2022 $310/$285 Put Verticals @ $2.52 Credit. DailyPlay Portfolio: By closing all 3 Contracts, we will be receiving $756.

View BEAM Trade

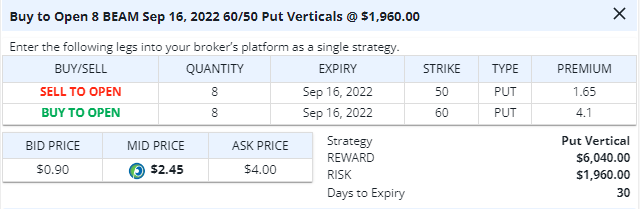

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 8 Contracts Sept 16, 2022 $60/$50 Put Verticals @ $2.45 Debit.

Total Risk: his trade has a max risk of $1,960 (8 Contracts x $245 per contract).

Counter Trend Signal: This is a Bearish trade on a stock that is experiencing a neutral to bullish trend.

1M/6M Trends: Neutral/Bullish

Technical Score: 3/10

OptionsPlay Score: 157

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Another up day for stocks, as the bulls can’t seemingly get their hands on enough shares to keep them satiated; they just come back each day for more. And we’re really happy about that, as we’ve been bullish the market since July and have been capturing the upmove. That being said, you know that I am very gingerly starting to get less bullish over time, and will be using the following month or so to reduce my equity exposure, using a combination of selling covered calls, shorting futures, shorting SPY and/or QQQ, and simply selling out of certain of my personal holdings as I see individual names reach targets that I am happy to say “au revoir” to after having held many of them for years.

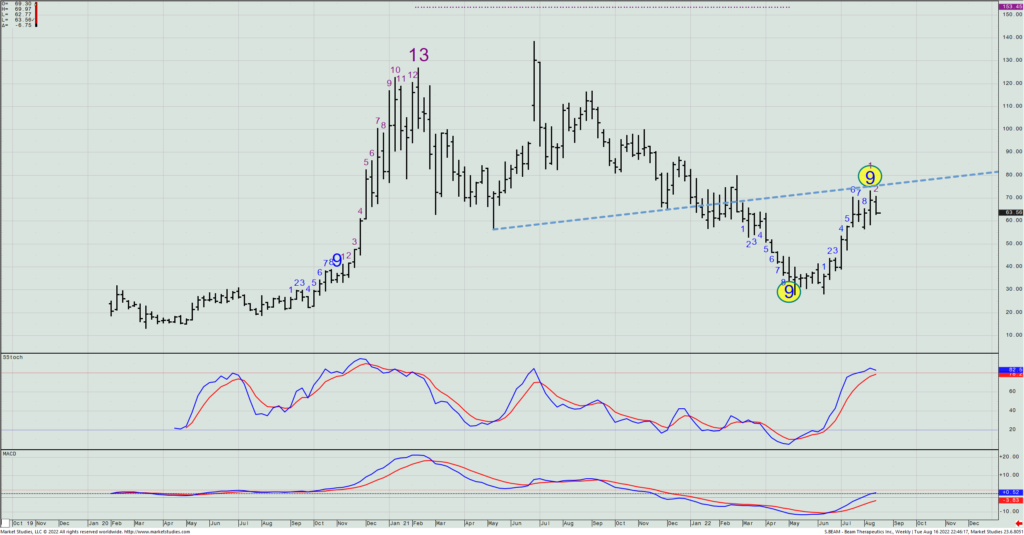

For a new trading idea for today, let’s look at one of the top 10 weighted holdings in Cathy Woods’ ARKK fund, Beam Therapeutics (BEAM). The name has less than three years of price history, and like many names in her flagship fund, was decimated earlier this year, but rebounded nicely since its bottom in May. But here’s the thing about its recent price action: it has gone nowhere in the past month while the market has zoomed upward.

Looking at the weekly chart, we see a Setup -9 one week before this year’s low, and now an opposite Setup +9 one week before its recent high last week. This makes it a significant underperformer this summer, and a candidate for lower prices on any corporate-specific negative news or just the whole market coming off.

BEAM – Weekly

The daily chart shows an Aggressive Sequential -13 one day before this year’s low, and a +13 one day after the rally’s high (just a few days ago).

BEAM – Daily

Put this data altogether, and we have a reason to now be bearish the name. As such, we are going to buy a BEAM September 16th $60/$50 put spread for $2.45 (based on Tuesday’s closing mid prices). The cost represents just 25% of the strike differential (but realize that it is also out of the money by ~ $3.50).

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on