DailyPlay – Opening Trade (PINS) & Closing Trade (TGT, NEM) – August 05, 2025

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read MoreInvestment Rationale

With the big CPI number out tomorrow and FOMC rate announcement/press conference on Wednesday, investors are poised for a potential game-changing move into year’s end. (These numbers will likely be THE driver of which direction we see trade through New Year’s.)

I remain in the camp that the Fed is not likely going to provide a Santa Claus rally, as I think they are lacking in enough data to make any type of pivot that staunch bulls are looking for. And without that potential bull move from positive numbers/comments, I think the bulls’ calls for a move to 4400 or even 4500 by year’s end is simply farcical.

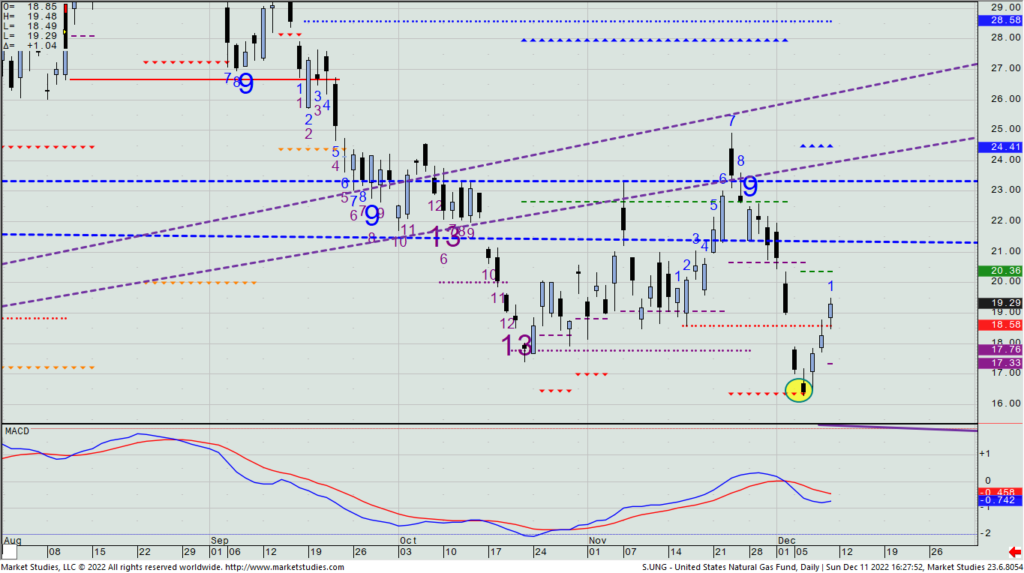

I do want to reduce some exposure before these numbers come out, making today the day to make the bulk of adjustments. Firstly, let’s remove 50% of our 20 long UNG Jan. 6th $16.50/$18.00 calls that we bought at 52 cents on the low of the move last week. The UNG closed on Friday at $19.29, so price is well-above the hedge strike price, and we’ll happily lock in a 65% partial profit in just four days of holding this spread.

UNG – Daily

Secondly, let’s remove 1 of 2 LEN short Dec. 16th $82.5/$77.5 put spreads. We’re up 63% on this and it expires on Friday.

Thirdly, let’s remove 2 of 3 GNRC short Dec. 23rd $100/$95 put spreads. We’re down 65% on this and I want to take the exposure well down before Wednesday’s FOMC statement.

We’re short 6 GE Jan. 6th $85/$90 call spreads, up 49%. Let’s take 2 of 6 off today.

We’re long 10 MDT Jan. 20th $80/$87 call spreads, down 26%. Let’s take 4 of 10 off today.

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read More

DailyPlay Portfolio Review Our Trades FSLR – 11 DTE...

Read More

MS Bullish Trade Adjustment Signal Investment Rationale...

Read More

SCHW Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on