DailyPlay – Adjusting Trade (GS) & Closing Trade (FSLR, CRWD) – August 08, 2025

Closing Trade GS Bullish Trade Adjustment Signal...

Read MoreStrategy: Short Put Vertical Spread

Direction: Bullish

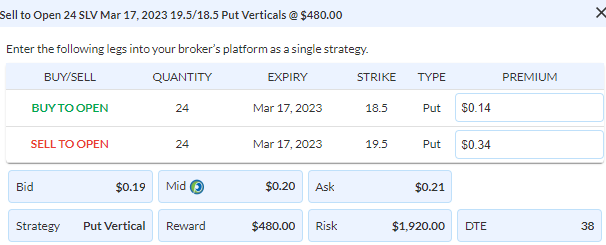

Details: Sell to Open 24 Contracts Mar 17th $19.50/$18.50 Put Vertical Spread @ $0.20 Credit per contract.

Total Risk: This trade has a max risk of $1,920 (24 Contracts x $80).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Neutral

Technical Score: 5/10

OptionsPlay Score: 96

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that this is a Conditional trade. The condition that has to be met, before you enter this bullish trade is if the price moves to $19.75 anytime in the next week. Therefore, the price for this trade will be different than what we are showing here, which is only acting as a guideline.

Investment Rationale

Yesterday, stocks started, as I expected, with as much as a 5% pullback, with the SPX having topped last week at its weekly bullish Propulsion Momentum level of 4148 (i.e., the same indicator that it failed at on the August high last summer). Though there are still earnings reports out every day, these names don’t really have market-moving impact (meaning that this week’s reports are more likely to generate individual stock movement, but unlikely to impact the overall market like when names like Apple, Google, or Microsoft report). Thus, other factors – including the dollar and bond yields – will more likely effect the overall stock market direction than anything else until the Feb. 14th CPI figure next Tuesday. (Fed Chair Powell does speak today at 12:40pm ET, so let’s see if he walks back any of his non-hawkish talk from last week.)

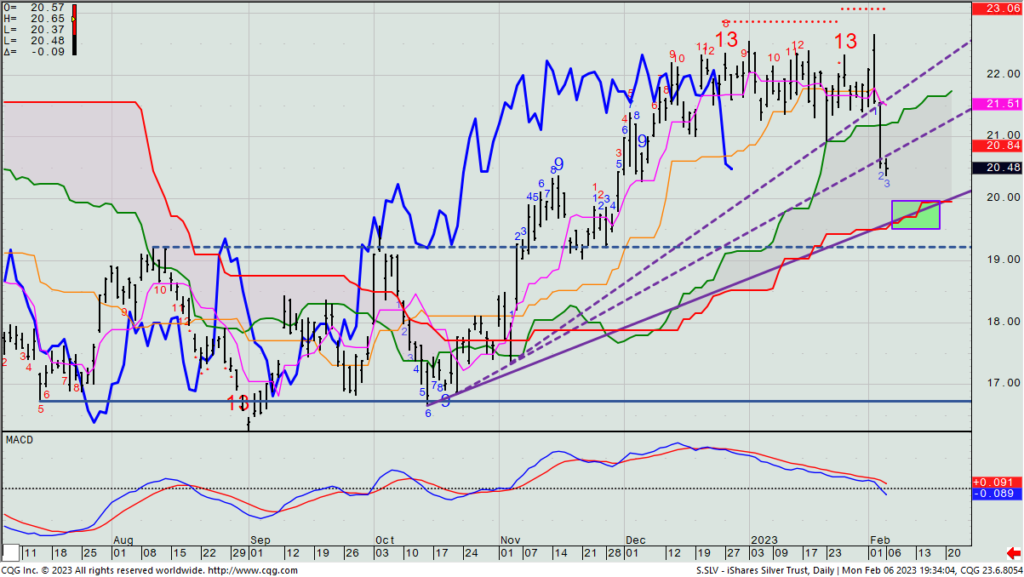

Here’s a new trade – and returning to an idea we recently had and fortunately got out of it just in time. I like silver over the medium term, but just last Friday exited a bullish trade to avoid the sell-off we’ve seen since. I have looked at where support now lies in the SPDR Silver Trust, and it appears that its lowest uptrend line coincides with the bottom of the cloud for the rest of the week.

SLV – Daily

Right now (to get a sense of what we might expect to collect on a credit spread) the current March 17th ATM/$1 OTM put spread ($20.5/$19.5) takes in a credit of 39% of the $1 strike differential. I’m not looking to put this bullish idea on now, but IF SLV reaches $19.75. That coincides with the cloud bottom (and highlighted in the green box), anytime in the next week, we’ll then look to sell the March 17th $19.50/$18.50 put spread at what is the then-current bid/offer mid-price.

If your portfolio allows it, I think you should also consider buying SLV shares outright down there for a full medium-term expected holding timeframe.

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read More

Share this on