DailyPlay – Adjusting Trade (GS) & Closing Trade (FSLR, CRWD) – August 08, 2025

Closing Trade GS Bullish Trade Adjustment Signal...

Read MoreStrategy: Long Call Vertical Spread

Direction: Bullish

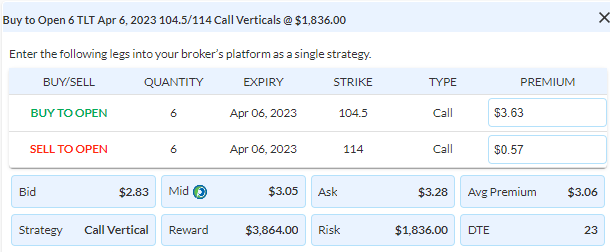

Details: Buy to Open 6 Contracts April 6th $104.50/$114 Call Vertical Spreads @ $3.05 Debit per contract.

Total Risk: This trade has a max risk of $1,836 (6 Contracts x $306) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $306 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish stock that is expected to continue its uptrend.

1M/6M Trends: Bullish/Bullish

Technical Score: 8/10

OptionsPlay Score: 109

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

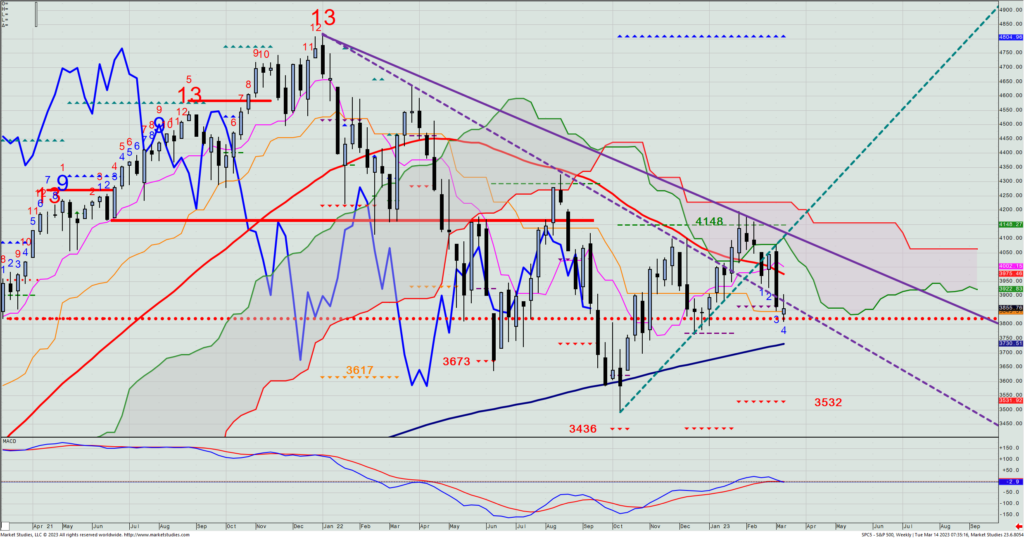

Here’s the good and the bad from yesterday’s price action: Despite the market closing lower on the day, buyers were actually evident with the day posting an “open” candle, meaning that the close was above the open. That suggests institutional buying was seen into the weakness. The “bad” (in the case of overall market direction), is that the lower open relative to last Friday’s close and the lower weekly low gives us two of three steps needed to confirm the last Friday’s qualified weekly close beneath the bearish Propulsion level of 3864. Though this actually helps better define the likely next bigger move, should this Friday close beneath last Friday’s close, we’d see a new bearish qualified and confirmed bearish Propulsion Momentum level triggered, suggesting there’s enough new downside momentum at hand to set up a further decline to 3532, the bearish Propulsion Exhaustion target price. And from my perspective, the more significantly the 3864 level would be breached this Friday, the more likely that 3532 target is a good one.

SPX – Weekly

I write this now – only Tuesday of this week – to help give you my overall thinking of where odds change from what could still be a trading range market. If we see the SPX close above 3864 on Friday, then the signal is not officially triggered, and we may still be in the trading range bounded by that level and 4148 on top.

For now, we still have to deal with the inflation numbers coming out today and tomorrow, and of course, that means we can see the market move sharply depending upon how they come in versus expectations. Certainly, volatility has picked up with the VIX in the mid-20s from what was recently under 20.

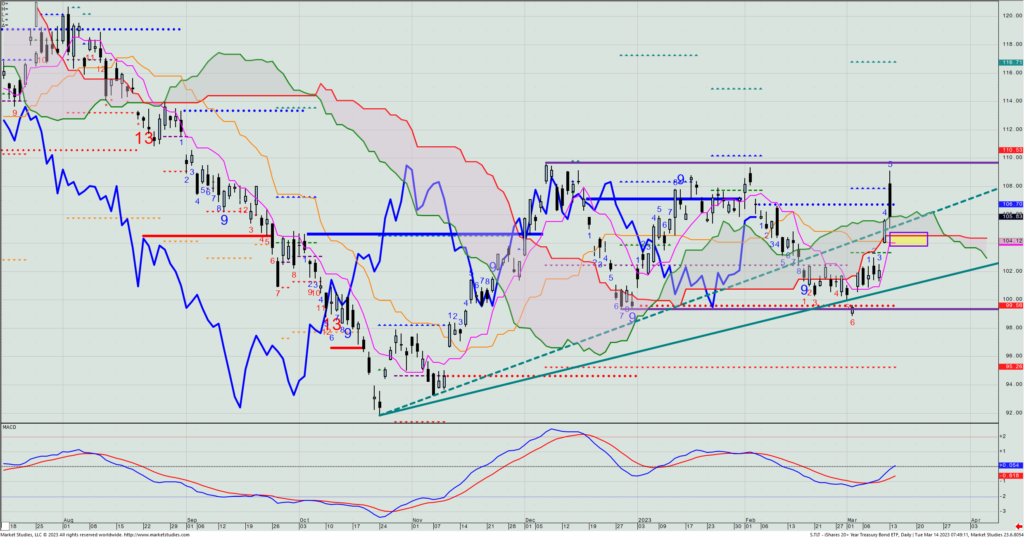

For a new Daily Play idea, I do think bond yields will not get back over 3.80% on this current move, and as such, I want to buy a minor pullback in the TLT. Looking at the daily chart, I would aim to get long into the highlighted yellow box, which is $104.50 to $104. This level could be seen today or tomorrow, so that if that occurs, we’ll want to buy the April 6th $104.5/$114 call spread for what is the then current bid/offer mid-price. (Yesterday, this closed at $3.06, or 32% of the strike differential).

TLT – Daily

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read More

Share this on