DailyPlay – Adjusting Trade (GS) & Closing Trade (FSLR, CRWD) – August 08, 2025

Closing Trade GS Bullish Trade Adjustment Signal...

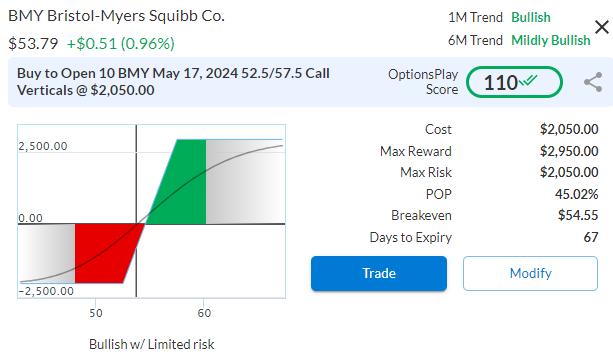

Read MoreWe took a stab at BMY at its very lows in Nov of last year and now that we have the confirmed bottom, it’s time to step back in. After underperforming for nearly a decade, BMY’s drug pipeline and fundamentals are starting to align for investors again. On the back of multiple FDA approvals and acquisitions, BMY is starting to show that it can generate growth again.

BMY has traded between $50 and $75 for nearly 10 years and recently tested these lows where we took an initial position in Nov. Now that is has completed it base and broken out above its $53 resistance level, this is a lower-risk entry for further upside into the low $60’s initial target. This recent move has also been accompanied with outperformance relative to its sector and the overall market.

BMY – Daily

BMY trades at only 7.5x forward earnings despite flat EPS, Revenue and FCF. This is a significant discount to the market that warrants further research given the outlook for its drug pipeline. BMY has acquired multiple pharmaceutical companies with some starting to pay off with an FDA approval for their lung cancer drug Augtyro. Additionally, multiple drugs in their pipeline that have been approved this past year are starting to see strong QoQ sales growth. So, with analysts sour on BMY, I believe now is the best time to have an eye on this 136-year-old pharmaceutical company.

Trade Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

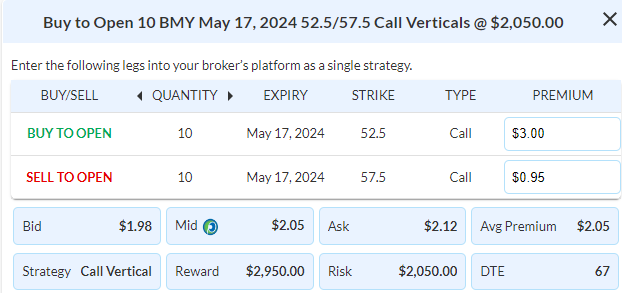

Details: Buy to Open 10 Contracts May 17th $52.50/$57.50 Call Vertical Spreads @ $2.05 Debit per contract.

Total Risk: This trade has a max risk of $2,050 (10 Contracts x $205) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $205 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bullish trade on a stock that is neutral and in a larger bullish trend.

1M/6M Trends: Bullish/Mildly Bullish

Relative Strength: 3/10

OptionsPlay Score: 110

Stop Loss: @ $1.03 Credit. (50% loss of premium paid)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read More

Share this on