DailyPlay – Portfolio Review – August 11, 2025

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

After yesterday’s FOMC meeting, we saw markets give up all intraday gains by the end of the session. We are opening up today higher, as markets seem to shrug off “high for longer” rates. In this environment, our base case remains very cautious as we continue to trade below the 50D SMA on the S&P 500 and will maintain our current positions in the portfolio.

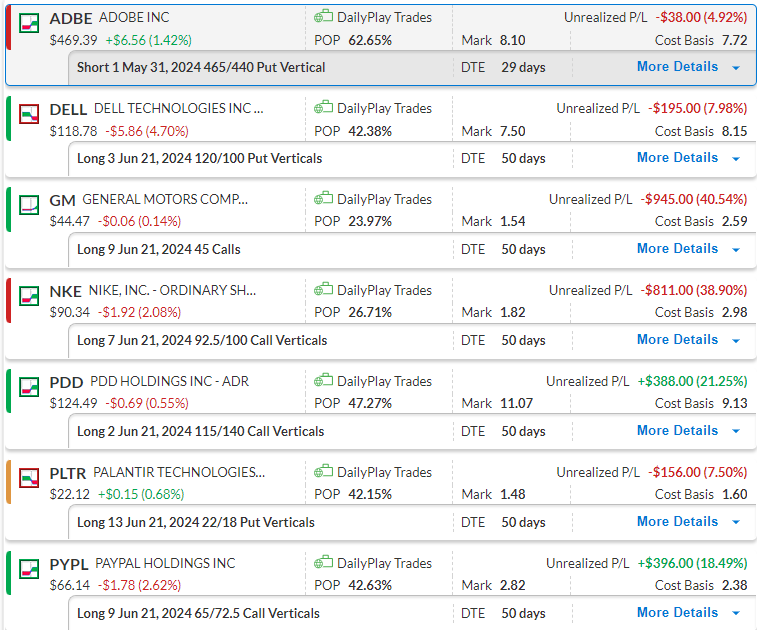

Bullish Credit Spread – ADBE is still holding onto support and a bounce off the level is expected.

Bearish Debit Spread – Dell corrected to the downside yesterday and our bearish thesis on this trade is standing

Bullish Calls – GM pulled back from recent highs and we will therefore monitor this trade to see if it again breaks above $45.

Bullish Debit Spread – NKE pulled back yesterday. We will keep an eye on this position as support at $88 should be respected.

Bullish Debit Spread – A break above $130 will confirm our bullish thesis on this trade and indicate that the next target is at around $140.

Bearish Debit Spread – We recently opened this position and resistance at $23 still holds.

Bullish Debit Spread – PYPL attempted a break above $67 resistance yesterday. We will continue to monitor this position.

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on