DailyPlay – Portfolio Review – August 11, 2025

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

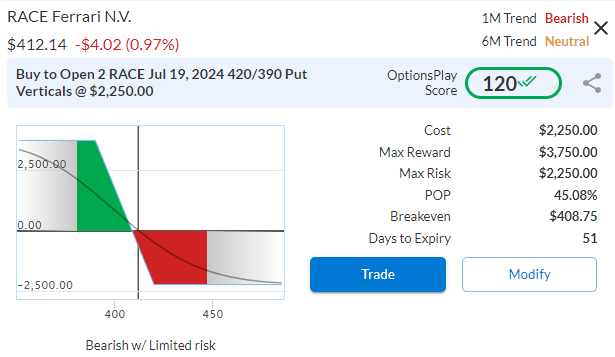

Read MoreAs Ferrari continues to print lower highs and lower lows with momentum turning negative, our position has finally swung into the green. Here is an opportunity for us to add some additional exposure as stocks start to turn lower in this higher interest environment. Still trading at over 49x forward earnings, RACE is at risk of a larger fall than many others. Look to add another 2% of our portfolio’s value to this bearish trade today.

RACE – Daily

Trade Details

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

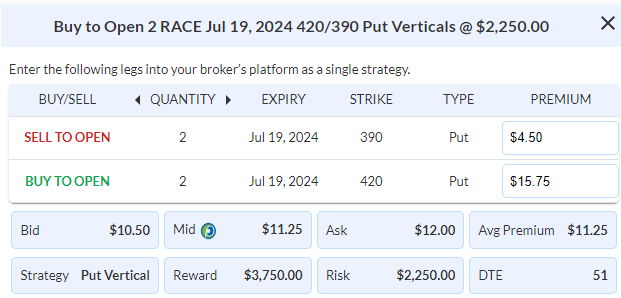

Details: Buy to Open 2 Contracts July 19th $420/$390 Put Vertical Spreads @ $11.25 Debit per Contract.

Total Risk: This trade has a max risk of $2,250 (2 Contracts x $1,125) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $1,125 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that recently turned bearish.

1M/6M Trends: Bearish/Neutral

Relative Strength: 6/10

OptionsPlay Score: 120

Stop Loss: @ $5.63 Credit. (50% loss of premium paid)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on