DailyPlay – Portfolio Review – August 11, 2025

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

Bullish Calls – We are closing this position today.

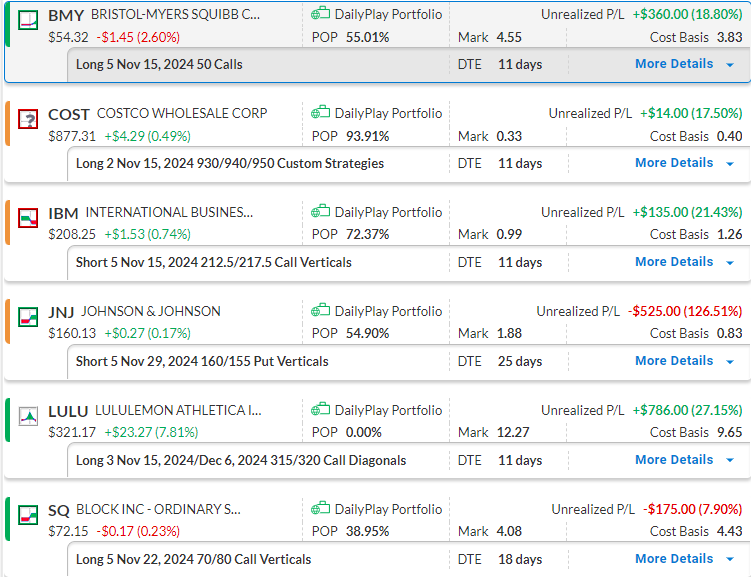

Bearish Modified Call Butterfly – We continue to hold a bearish outlook on Costco (COST) from a valuation standpoint, staying the course on the position, which is up slightly.

Bearish Credit Spreads – IBM continues to indicate overbought signals, reinforcing our bearish stance. We’ll hold steady on the position, which has gained slightly.

Bullish Credit Spreads – JNJ has been volatile recently and has returned to its downside support level, which has been unfavorable for this trade, as it is also the short strike of our put vertical spread. With 26 days until expiration, we need to monitor this position closely.

Bullish Call Diagonals – We are closing this position today.

Bullish Debit Spread – SQ’s rapid growth suggests it could soon reach a more reasonable valuation of 19-20x forward earnings. With the company’s earnings expected on November 7th, there’s a strong chance we will hold this position through the report. We’ll stay the course on this position as the earnings date approaches.

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on