DailyPlay – Portfolio Review – August 11, 2025

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

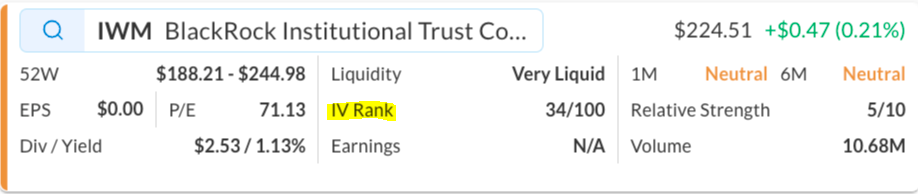

Read MoreThe Daily Play today is a long straddle in the IWM. The rationale for considering this strategy in the Russell 2000 Small Cap Index, using the IWM ETF, is straightforward. Recently, the ETF has been trading within a tight range. Small-cap stocks are particularly sensitive to interest rate fluctuations, and inflation disproportionately affects them.

With the presidential inauguration on Monday and the transition of power, speculation is mounting, especially regarding tariffs, tax policy, spending, and debt management. Additionally, there’s uncertainty about how the Federal Reserve will evolve under the Trump administration.

We expect significant headlines in the coming days, though it’s unclear whether markets will react positively or negatively. This environment makes a long straddle appealing, as it positions for potential sharp moves in either direction.

Currently, the implied volatility rank (IV rank) on the platform is 34/100, indicating that volatility is at the lower end of the range. This suggests it’s not a bad entry point for buying options. Option traders use IV rank to determine whether implied volatility is high or low based on the past year’s data. High IV may indicate a selling opportunity, while low IV may suggest a buying opportunity.

At 34/100, IV is on the lower end, as 50/100 represents the midpoint. Once the strategy is established, an increase in implied volatility is ideal, as it raises the value of both options and suggests a greater likelihood of a price swing.

Strategy: Long Straddle

Direction: Sharp Move Straddle

Details: Buy to Open 2 IWM Feb 21, 2025 $225 Straddles @ $10.85 Debit per Contract.

Total Risk: This trade has a max risk of $2,170 (2 Contracts x $1,085) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $1,085 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue its long-term bullish trajectory.

1M/6M Trends: Neutral/Neutral

Relative Strength: 5/10

OptionsPlay Score: 56

Stop Loss: @ $5.39 (50% loss of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on