DailyPlay – Portfolio Review & Opening Trade (BAC) – March 3, 2025

DailyPlay Portfolio Review

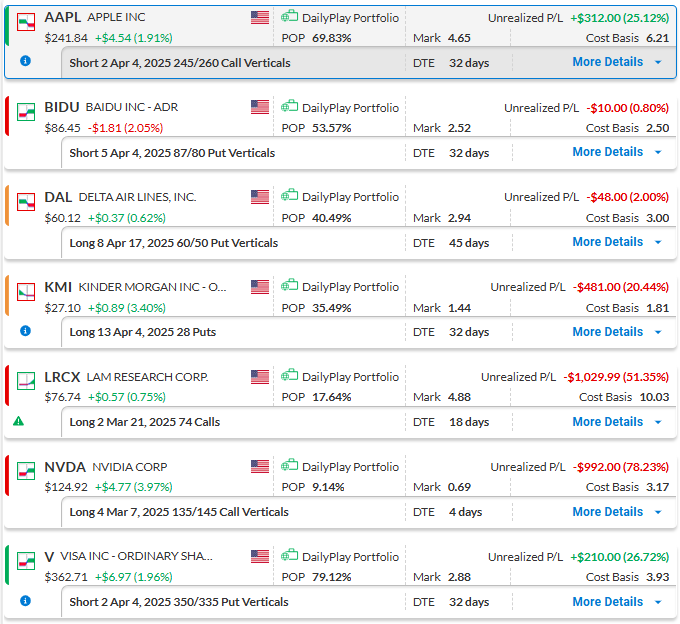

Our Trades

AAPL – 32 DTE

Bearish Credit Spread – Apple Inc. (AAPL) – This position was established recently and is profitable. We plan to hold steady for now.

BIDU – 32 DTE

Bullish Credit Spread – Baidu, Inc. (BIDU) – Since opening this position, there have been no significant changes, so we plan to hold for now.

DAL – 45 DTE

Bearish Debit Spread – Delta Air Lines, Inc. (DAL) – We recently established this position and plan to stay the course for now.

KMI – 32 DTE

Bearish Long Put – Kinder Morgan Inc. (KMI) – Since establishing this position, we are slightly down. We plan to hold steady for now.

LRCX – 18 DTE

Bullish Long Call – Lam Research Corporation (LRCX) – This position is at a loss, and with expiration only weeks away, it’s time to either sell a call to create a bull call spread or close it outright. We’ll closely monitor it early in the week.

NVDA – 4 DTE

NVDA delivered a strong earnings beat last week, but market headlines overshadowed the results. With expiration approaching, the position is still down, though Friday’s momentum was encouraging, and we hope it continues, offering an opportunity to recover some value.

V – 32 DTE

Visa’s strong upward momentum continues. We’re profitable and maintaining our position for now.

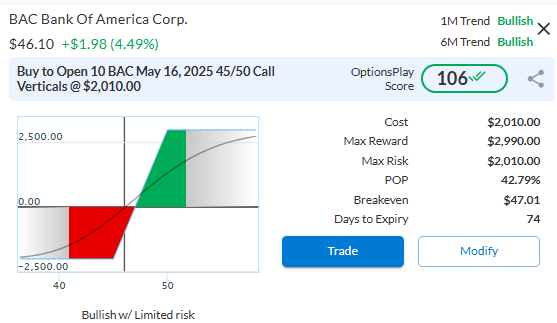

BAC Bullish Opening Trade Signal

Investment Rationale

The financial sector is experiencing favorable tailwinds, with interest rates enhancing net interest margins for major banks like BAC. Bank of America (BAC) is presenting a bullish opportunity as it bounces off support, setting the stage for potential breakout to all-time highs. Additionally, BAC’s balance sheet and diversified revenue streams position it to capitalize on improving regulatory environment and increased lending activity. Trading at an attractive valuation with solid growth metrics, BAC is poised to benefit from these macro trends, making it an appealing investment within the financial sector.

The chart confirms BAC’s bullish setup, as the stock recently bounced off its $43 support and is now approaching the $48 double top. A breakout above this level could propel BAC to our $55 upside target.

Fundamentals: Attractively Valued

BAC trades at a slight discount to its industry, with growth and profitability metrics that highlight its potential for outperformance. The bank’s strong fundamentals and favorable macro environment bolster its investment case.

- PB Ratio: 1.29x vs. Industry Average 1.37x

- EPS Growth: 15.29% vs. Industry Average 13.83%

- Revenue Growth: 5.80% vs. Industry Average 5.28%

- Net Margins: 26.63% vs. Industry Average 24.02%

Bullish Thesis:

- Favorable Interest Rate Environment: Interest rates are boosting BAC’s net interest margins, a key driver of profitability for the bank.

- Strong Balance Sheet: BAC’s diversified revenue streams and solid capital position provide resilience and growth potential in a recovering economy.

- Increased Lending Activity: Improving domestic regulatory conditions are driving higher loan demand, benefiting BAC’s core banking operations.

BAC – Daily

Trade Details

Strategy Details

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

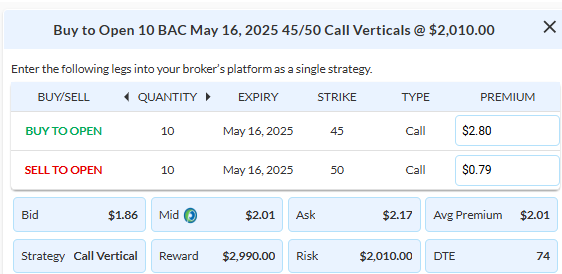

Details: Buy to Open 10 Contracts BAC May 16 $45/$50 Call Vertical Spreads @ $2.01 Debit per Contract.

Total Risk: This trade has a max risk of $2,010 (10 Contracts x $201) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $201 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 106

Stop Loss: @ $1.01 (50% loss of premium)

View BAC Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Friday ‘s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View BAC Trade

More DailyPlay

DailyPlay – Opening Trade (LOW) & Closing Trade (XYZ, MU) – August 12, 2025

Closing Trade LOW Bullish Opening Trade Signal Investment...

Read More

DailyPlay – Portfolio Review – August 11, 2025

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

DailyPlay – Adjusting Trade (GS) & Closing Trade (FSLR, CRWD) – August 08, 2025

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

Share this on