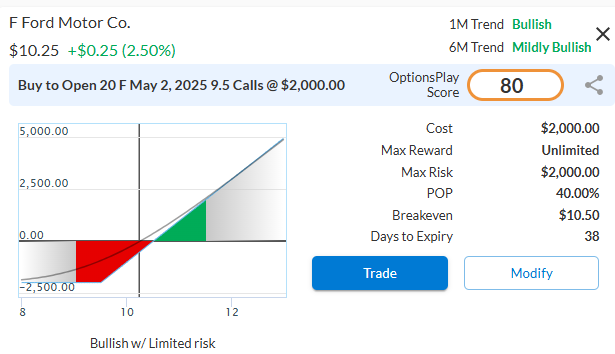

DailyPlay – Opening Trade (F) – March 25, 2025

F Bullish Opening Trade Signal

Investment Rationale

Ford Motor Co. (F) is positioned for a rally as it breaks out above resistance, fueled by the recent exclusion of autos from tariffs announced on April 2, which is expected to drive a broader rally in auto stocks. This tariff relief removes a significant overhang for the sector, allowing Ford to benefit from improved cost structures and enhanced competitiveness in key markets. Ford’s focus on electric vehicles (EVs) and its strong lineup of traditional vehicles continue to resonate with consumers, while its undervalued fundamentals provide a margin of safety for investors. With the stock outperforming the S&P 500 and showing strong momentum, F is an attractive opportunity in the auto sector amidst this favorable policy shift.

The chart confirms F’s bullish setup, as the stock has broken through a key resistance level at $10 with strong momentum, outpacing the S&P 500. The breakout supported by positive volume trends indicates potential for a rally towards our $12.50 target.

Ford trades at a substantial discount to its peers despite exhibiting growth metrics that outperform its industry, suggesting there is significant upside potential.

- Forward PE Ratio: 7.62x vs. Industry Average 10.18x

- Expected EPS Growth: 11.38% vs. Industry Average 6.40%

- Expected Revenue Growth: -2.79% vs. Industry Average 2.70%

- Net Margins: 3.18% vs. Industry Average 3.53%

Bullish Thesis:

- Tariff Relief: The exclusion of autos from tariffs announced on April 2, 2025, removes a major cost burden, boosting Ford’s profitability and competitiveness, and driving a potential rally in auto stocks.

- EV and Traditional Vehicle Strength: Ford’s strategic focus on electric vehicles, alongside its strong traditional vehicle lineup, positions it to capture market share in a recovering auto sector.

Undervalued Opportunity: Trading at a significant discount to its peers with solid EPS growth, Ford offers an attractive risk-to-reward profile for investors.

F – Daily

Trade Details

Strategy Details

Strategy: Long Call

Direction: Bullish Call

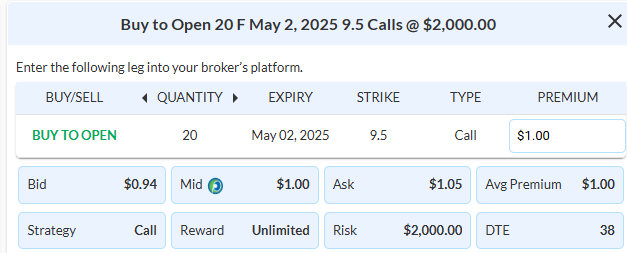

Details: Buy to Open 20 Contracts Ford May 2 $9.50 Call @ $1.00 Debit per Contract.

Total Risk: This trade has a max risk of $2,000 (20 Contracts x $100) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $100 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Mildly Bullish

Relative Strength: 7/10

OptionsPlay Score: 80

Stop Loss: @ $0.50 (50% loss of premium)

View F Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View F Trade

More DailyPlay

DailyPlay – Opening Trade (LOW) & Closing Trade (XYZ, MU) – August 12, 2025

Closing Trade LOW Bullish Opening Trade Signal Investment...

Read More

DailyPlay – Portfolio Review – August 11, 2025

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

DailyPlay – Adjusting Trade (GS) & Closing Trade (FSLR, CRWD) – August 08, 2025

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

Share this on