DailyPlay – Opening Trade (TFC) – September 03, 2025

TFC Bullish Opening Trade Signal Investment Rationale...

Read MoreDailyPlay Portfolio Review

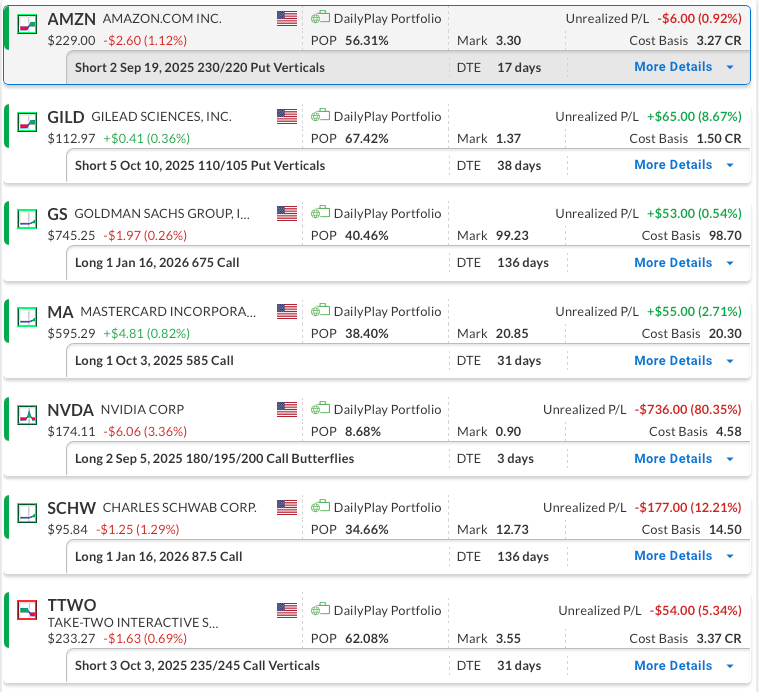

Our Trades

AMZN – 17 DTE

Bullish Credit Spread – Amazon.com, Inc. (AMZN) – The stock showed strength last week, pulled back from the recent high, and if it can break out above 236, the next resistance level is at 241. We plan to stay the course as the trade develops.

GILD – 38 DTE

Bullish Credit Spread – Gilead Sciences (GILD) – We recently established this position and we plan to stay the course for now.

GS – 136 DTE

Bullish Long Call – Goldman Sachs Group, Inc. (GS) – We recently initiated this position and intend to maintain it. Continued strength in the financial sector, driven by Powell’s dovish comments at Jackson Hole, remains supportive for GS.

MA – 31 DTE

Bullish Long Call – Mastercard Incorporated (MA) – We opened this position with a straight long call due to the implied volatility (IV) rank being very low at 6/100, which made spread strategies less attractive compared to buying the call outright. For now, we plan to hold the position.

NVDA – 3 DTE

Bullish Butterfly – NVIDIA Corporation (NVDA) – Following a solid earnings report where NVIDIA (NVDA) exceeded analyst expectations on both revenue and earnings, the company delivered another record quarter, driven largely by its Data Center business. Despite the strong results, the stock traded slightly lower after the announcement and then pulled back further with the broader market on Friday. Given the limited time left in the trade, we intend to exit at a modest loss if early-week price action turns bullish; otherwise, there will be nothing to salvage.

SCHW – 136 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – We continue to see upside potential, supported by strong fundamentals and resilience in the financial sector. We closed our initial long call position once the option’s delta hit 1.00, then shifted into a higher strike call with a 0.80 delta and a later expiration. We plan to hold steady with this adjustment.

TTWO – 31 DTE

Bearish Credit Spread – Take-Two Interactive Software, Inc. (TTWO) – We recently established this position and we plan to stay the course for now.

TFC Bullish Opening Trade Signal Investment Rationale...

Read More

GILD Bullish Opening Trade Signal Investment Rationale...

Read More

NVDA Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on