DailyPlay – Opening Trade (SPOT) & Closing Trade (GILD, SNPS) – September 11, 2025

Closing Trade SPOT Bearish Opening Trade Signal Investment...

Read MoreDailyPlay Portfolio Review

Our Trades

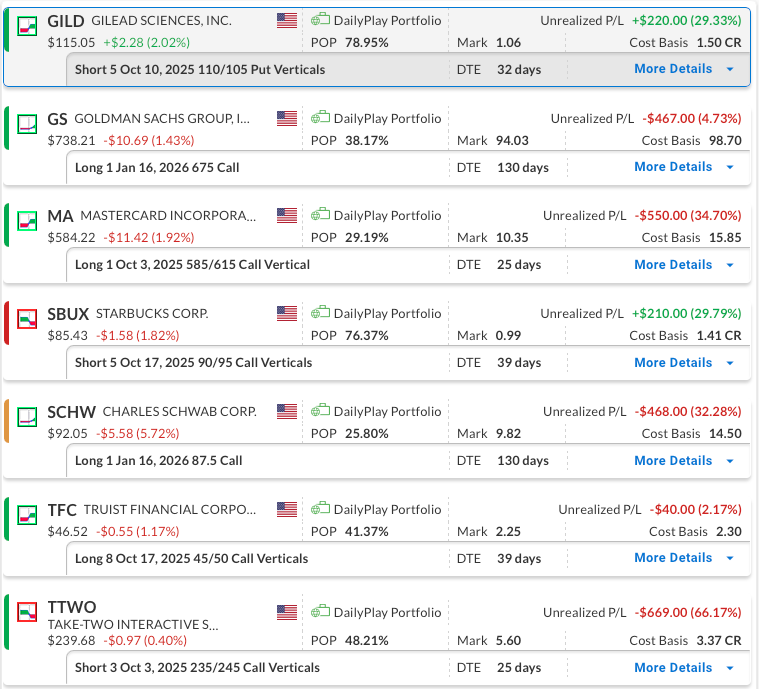

GILD – 32 DTE

Bullish Credit Spread – Gilead Sciences (GILD) – The position is currently profitable. We established this position with the view that the bullish thesis remains intact as long as $110 support holds, and we plan to stay the course for now.

GS – 130 DTE

Bullish Long Call – Goldman Sachs Group, Inc. (GS) – Our outlook remains bullish over the longer term, and we intend to hold the position. A weaker-than-expected jobs report on Friday pressured shares of major banks and brokerages, including Goldman Sachs.

MA – 25 DTE

Bullish Debit Spread – Mastercard Incorporated (MA) – We initially entered this position with a straight long call due to the very low IV rank of 6/100, which made spreads less attractive. The position has moved lower with the financial sector, and with less than 30 days to expiration, we converted to a bull call spread last week by adding a short option to reduce risk while retaining meaningful upside. This adjustment limits potential gains on a sharp breakout but keeps the trade aligned with our bullish outlook.

SBUX – 39 DTE

Bearish Credit Spread – Starbucks Corporation (SBUX) – We recently established this position and we plan to stay the course for now.

SCHW – 130 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – We maintain our bullish outlook on Schwab. After our initial long call reached a delta of 1.00, we captured the gain and rolled into a higher strike call with a 0.80 delta and later expiration. Shares of major banks and brokerages, including Schwab, moved lower on Friday after a weaker-than-expected jobs report raised concerns about a slowing economy, as financial institutions are sensitive to both inflationary pressures and economic slowdowns. We will continue to monitor the position and may sell calls to reduce risk if the timing is appropriate.

TFC – 39 DTE

Bullish Debit Spread – Truist Financial Corporation (TFC) – We recently established this position and we plan to stay the course for now.

TTWO – 25 DTE

Bearish Credit Spread – Take-Two Interactive Software, Inc. (TTWO) – TTWO faces short-term downside pressure as the \$240 level acts as near-term resistance and momentum shows signs of fading. The position is currently negative, but with time remaining, we plan to hold and monitor whether the resistance area holds in the short term.

Closing Trade SPOT Bearish Opening Trade Signal Investment...

Read More

Closing Trade SNPS Bullish Opening Trade Signal Investment...

Read More

Closing Trade MA Bullish Trade Adjustment Signal...

Read More

Share this on