DailyPlay – Portfolio Review – August 11, 2025

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

Markets are off to a risk-off tone with back-to-back days where sellers maintained control throughout the entire session with strong volume. We saw a similar start last week before buyers stepped back in with an even stronger volume. However, this week’s selloff has been coupled with 10-year bond yields surging above 4.3%. At this time we are going to hold off on establishing new positions and managing our long and short positions. If we see further momentum to the downside, AMGN, PLTR, COST, and INTU are prime candidates to start adding short exposure.

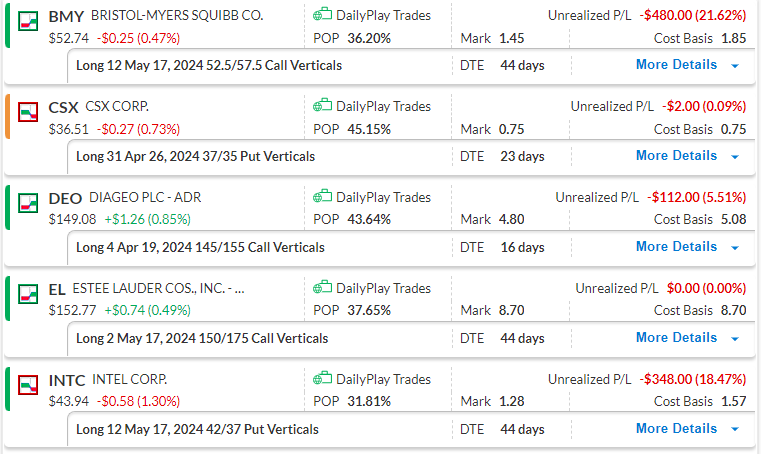

Bullish Debit Spread – Started to pull back slightly, our thesis remains intact as the stock continues to make higher highs and higher lower. We will stop out of BMY closes below $51.50, otherwise, we are holding onto this for further upside.

Bearish Debit Spread – Downtrend remains intact and we’re looking for further downside from stops just above $37. If CSX is closed lower at the end of this week, we will be adding more exposure to this position into the weekend.

Bullish Debit Spread – Slowly but surely the trade thesis still remains solid, stops below $145 and we are less than $1 away from our breakeven.

EL – 44 DTE

Bullish Debit Spread – We just initiated this trade yesterday. Encouraged that EL is up nearly 1% despite a heavy day of selling.

INTC – 44 DTE

Bearish Debit Spread – With 44 days still left, INTC is trading sideways and printing lower highs. Holding onto this and looking for further downside.

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on