DailyPlay – Portfolio Review – December 08, 2025

DailyPlay Portfolio Review Our Trades FDX – 25 DTE...

Read MoreDailyPlay Portfolio Review

Our Trades

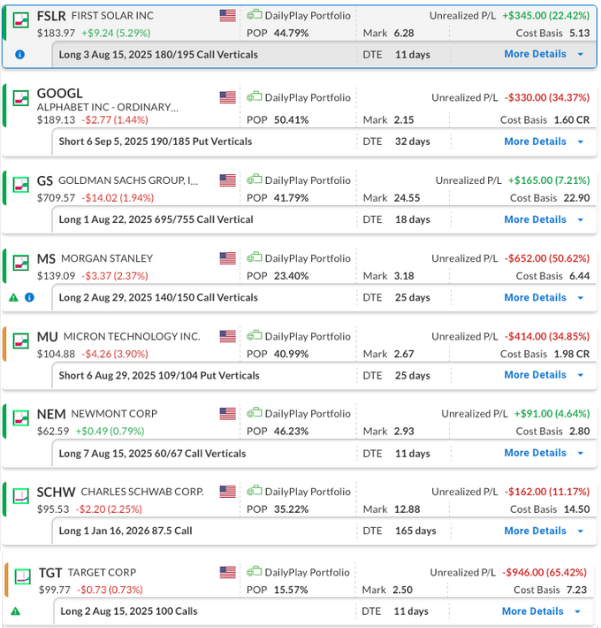

FSLR – 11 DTE

Bullish Debit Spread – First Solar, Inc. (FSLR) – The stock gained bullish momentum following last week’s strong earnings report. We plan to maintain the position for now, but with limited time until expiration—given that it was designed as an earnings play—we are monitoring it closely. The trade is currently profitable, and we expect the upward trend to continue, though we’ll keep the position on a short leash.

GOOGL – 32 DTE

Bullish Debit Spread – Alphabet Inc. (GOOGL) – The position is currently down. However, the stock is trading above all major moving averages, with the 20-day MA providing short-term support. With sufficient time remaining until expiration, we plan to continue holding the trade.

GS – 18 DTE

Bullish Debit Spread – Goldman Sachs Group, Inc. (GS) – Despite a strong post-earnings rally, the position has recently moved into negative territory. With sufficient time remaining until expiration, we plan to hold and may explore an adjustment this week to reduce overall risk.

MS – 25 DTE

Bullish Debit Spread – Morgan Stanley (MS) – Morgan Stanley delivered a solid quarterly earnings report. However, the stock sold off afterward, and the position is showing a slight loss. We executed an adjustment last week to lower the overall risk, and with decent time remaining until expiration, along with the reduced risk from the adjustment, we plan to continue holding the position for now.

MU – 25 DTE

Bullish Credit Spread – Micron Technology, Inc. (MU) – The position is currently at a loss following a pullback from recent highs. The stock closed the week lower, breaking below the 50-day moving average, which had been acting as support. We plan to continue holding the trade but will monitor closely to see if the weakness persists.

NEM – 11 DTE

Bullish Debit Spread – Newmont Corporation (NEM) – The trade is currently showing a gain after the company’s earnings report pushed the stock to a new 52-week high. The stock pulled back this week following the strong post-earnings rally. We plan to continue holding the position.

SCHW – 165 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – We maintain a positive outlook, driven by solid company fundamentals and ongoing strength across SCHW and the broader financial sector. The company reported solid earnings, and the stock made a strong upside move following the announcement, but has since pulled back with the financial sector as a whole. We will stay the course for now.

TGT – 11 DTE

Bullish Long Call – Target Corporation (TGT) – The trade has faltered after initial progress. With the stock closing under the 100 support level and limited time remaining, we will consider exiting the position unless we see a positive move early in the week.

DailyPlay Portfolio Review Our Trades FDX – 25 DTE...

Read More

MU Bullish Opening Trade Signal Investment Rationale...

Read More

NVDA Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on