DailyPlay – Adjusting Trade (GS) & Closing Trade (FSLR, CRWD) – August 08, 2025

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

As traders await the Jobs numbers this morning, equities are hovering just around all-time highs. We expect a bad news is good news type event where any weakness in job numbers would imply more room for the Fed to cut rates, providing a headwind for equities. We are taking a pause from adding additional exposure in our DailyPlay portfolio until we have more clarity around these economic numbers.

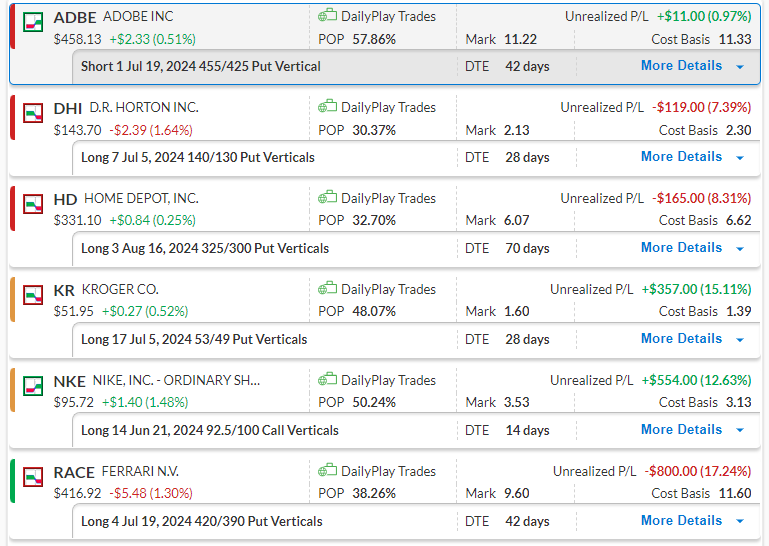

Bullish Credit Spread – We’re set up for a breakout above $460 going into earnings next week.

Bearish Debit Spread – Weakness in housing continues as DHI fails to break higher and potentially retests $140 support.

Bearish Debit Spread – Just sitting above the $330 support level that we are targeting a break below.

Bearish Debit Spread – Weakness has continued and we are targeting the $50.50 gap fill as our initial downside target.

Bullish Debit Spread – Bottoming formation is looking more constructive but yet to break out above $96.

Bearish Debit Spread – Continues to remain rangebound, but a break above $423 would invalidate our thesis and require closing out.

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read More

Share this on