DailyPlay – Opening Trade (META) – October 07, 2025

META Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

Meta Platforms (META) presents a compelling bullish setup as the stock consolidates near prior breakout levels following a year of strong relative performance. Despite the recent market-wide pullback in large-cap technology, META remains well-positioned through its dominance in digital advertising and accelerating growth in AI-driven monetization. The upcoming October 29 earnings announcement—scheduled before the trade’s expiration—acts as a potential upside catalyst, with continued efficiency gains and margin expansion supporting a long-term target near $900.

Technical Analysis

META has retraced modestly after a strong advance earlier this year, finding firm support near the $700 level, which aligns with its prior breakout zone from the summer. The stock continues to trade comfortably above its 200-day moving average around $667, confirming the prevailing long-term uptrend despite recent volatility. Meanwhile, the 20-day and 50-day moving averages have begun to stabilize, suggesting a period of consolidation that may precede the next upward move.

Fundamental Analysis

META’s valuation remains compelling given its superior profitability and growth relative to peers. Despite trading at a modest premium to the sector, its expanding margins and strong top-line momentum highlight the strength of its business model and future cash flow potential.

- Forward PE Ratio: 23.79x vs. Industry Median 21.56x

- Expected EPS Growth: 11.57% vs. Industry Median 14.25%

- Expected Revenue Growth: 16.33% vs. Industry Median 12.95%

- Net Margins: 39.99% vs. Industry Median 3.98%

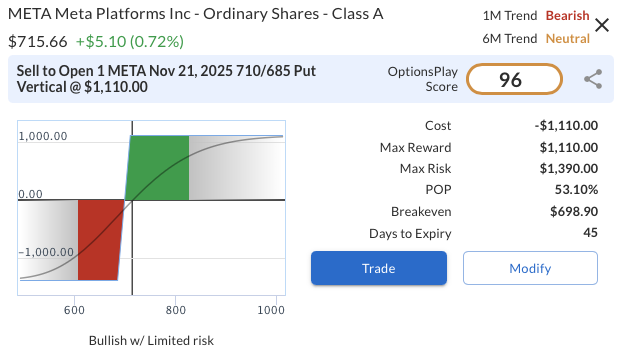

Options Trade

The proposed trade is a bullish put vertical spread, selling the META Nov 21, 2025 710/685 put spread for a credit of $11.10. This position profits if META remains above $710 at expiration, collecting a maximum reward of $1,110 against a defined risk of $1,390. With the earnings event occurring before expiration, implied volatility is elevated, enhancing the credit received. The structure provides a favorable risk/reward ratio of 1:1.25, allowing traders to express a bullish stance while maintaining a defined downside if META experiences temporary post-earnings weakness.

META – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 1 META Nov 21 $710/$685 Put Vertical Spreads @ $11.10 Credit per Contract.

Total Risk: This trade has a max risk of $1,390 (1 Contract x $1,390) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $1,390 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bearish/Neutral

Relative Strength: 7/10

OptionsPlay Score: 96

Stop Loss: @ $22.20 (100% loss to value of premium)

View META Trade

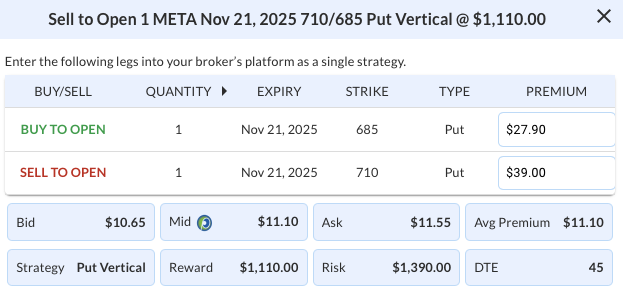

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View META Trade

More DailyPlay

DailyPlay – Opening Trade (MU) – December 04, 2025

MU Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Opening Trade (NVDA) – December 03, 2025

NVDA Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Adjusting Trade (META) – December 02, 2025

META Bullish Trade Adjustment Signal Investment...

Read More

Share this on