DailyPlay – Portfolio Review – August 04, 2025

DailyPlay Portfolio Review Our Trades FSLR – 11 DTE...

Read MoreInvestment Thesis:

Tesla Inc. (TSLA) presents a compelling bearish setup ahead of its Q2 earnings report, scheduled for Wednesday, July 23rd after market close. Despite optimism around its long-term innovation narrative, near-term price action and valuation continue to decouple from realistic fundamental support. The stock has recently failed to sustain momentum above key resistance levels, while sentiment has turned more cautious amid broader EV demand concerns and increasingly competitive market dynamics. With earnings risk approaching and limited upside catalysts, TSLA offers a tactically favorable short opportunity into the event.

Technical Analysis:

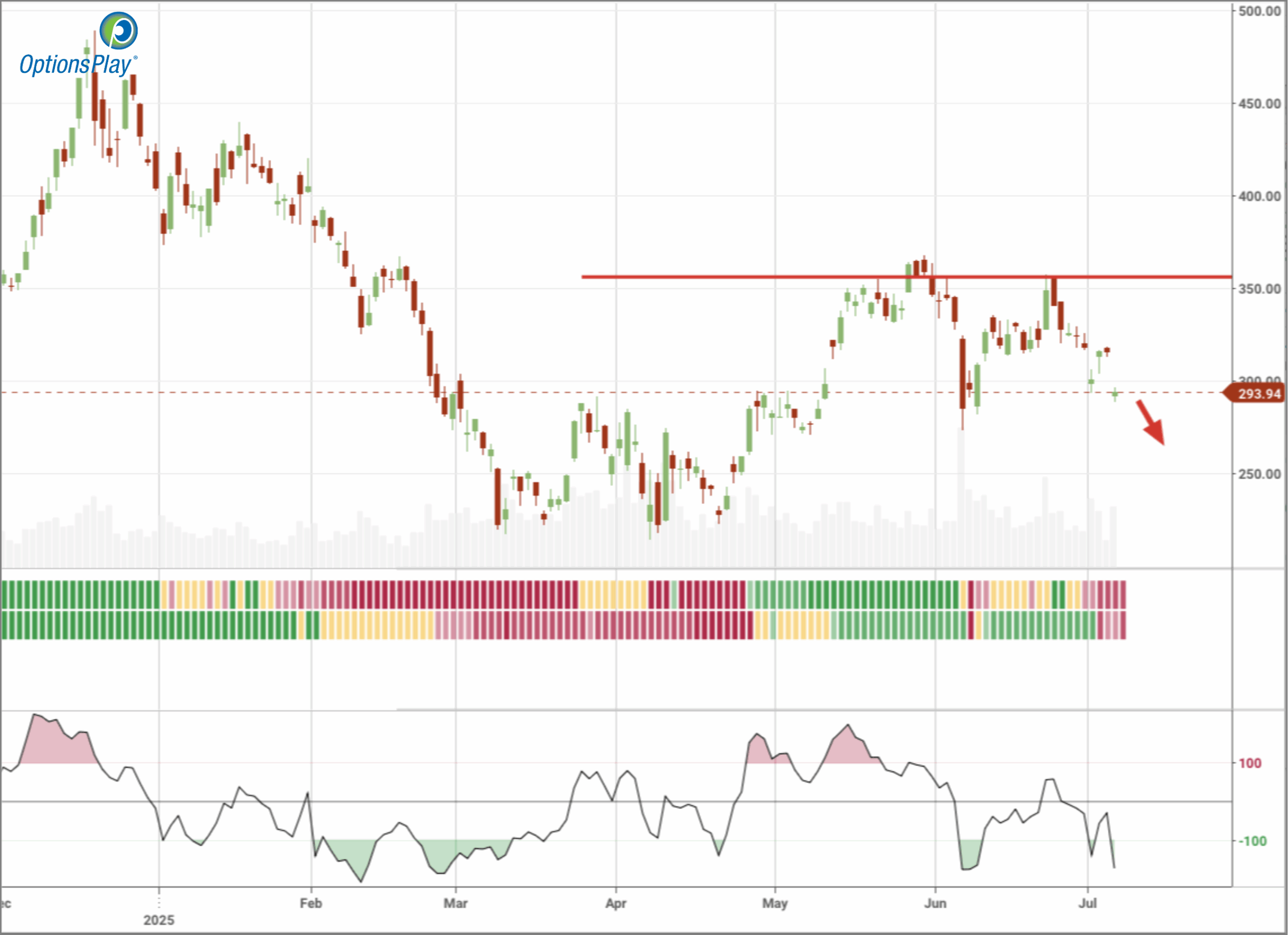

Price action in TSLA shows persistent distribution beneath the $350 resistance zone, where sellers have repeatedly capped rallies over the past year. The stock has now broken below its 50-day and 20-day moving averages, with a fresh bearish crossover developing between the short-term MAs. The rejection near $318 in early July reinforces this technical weakness, and momentum indicators like RSI have slipped toward neutral-bearish territory at 40. A breakdown below $290 confirms a lower high and opens the door toward the $250 support region, with the $180 level representing a longer-term downside target.

Fundamental Analysis:

TSLA remains fundamentally overvalued even as growth expectations compress and margins tighten under macro and competitive pressure. While Tesla’s topline metrics continue to outpace the sector, the extreme premium attached to its stock is increasingly difficult to defend.

Options Trade:

With implied volatility elevated ahead of earnings and recent news headlines adding downside pressure, this structure offers a defined-risk way to express a bearish view. The 295/245 bear put vertical spread balances risk while providing strong convexity to the downside. The maximum potential reward of $3,344 vs. a defined risk of $1,656 delivers a favorable risk-reward ratio into a potentially volatile setup with 31 days to expiration.

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 1 TSLA Aug 08 $295/$245 Put Vertical Spreads @ $16.56 Debit per Contract.

Total Risk: This trade has a max risk of $1,656 (1 Contract x $1,656) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $1,656 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Bearish/Bearish

Relative Strength: 2/10

OptionsPlay Score: 127

Stop Loss: @ $8.28 (50% loss of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

DailyPlay Portfolio Review Our Trades FSLR – 11 DTE...

Read More

MS Bullish Trade Adjustment Signal Investment Rationale...

Read More

SCHW Bullish Opening Trade Signal Investment Rationale...

Read More

Closing Trade FSLR Bullish Opening Trade Signal Investment...

Read More

Share this on