DailyPlay – Adjusting Trade (MS) – August 01, 2025

MS Bullish Trade Adjustment Signal Investment Rationale...

Read MoreStrategy: Short Call Vertical Spread

Direction: Bearish

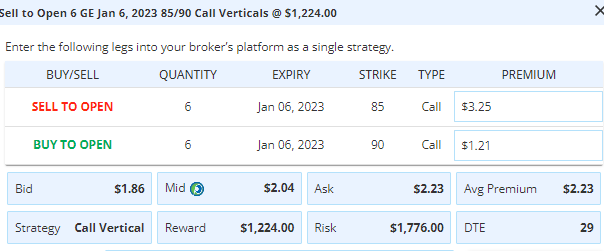

Details: Sell to Open 6 Contracts Jan. 6th $85/$90 Call Vertical Spreads @ $2.04 Credit.

Total Risk: This trade has a max risk of $1,776 (6 Contracts x $296).

Counter Trend Signal: This is a Bearish trade on a stock that is experiencing a neutral to bullish trend.

1M/6M Trends: Neutral /Bullish

Technical Score: 9/10

OptionsPlay Score: 104

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Stocks had a quiet session on Wednesday, as most PMs are waiting till next week’s CPI and Fed news to make their next key decisions. Before I get to a new idea for today, let’s make sure you get out of the last two USO Dec. 9th put spreads we have on that expire tomorrow. What was a good bottom-fishing trade quickly turned around this week to turn into a loser, as oil has fallen to new 2022 lows.

We also have a long ZTS $150/$160 call spread that has done a turnaround after having initially worked. We’re back to breakeven on it (luckily, we had already reduced some of the position with a profit), so let’s just get out of the rest today. Roundtrips back to where we first got into a call spread is usually not something that I want to hold.)

For a new trade, I have one that not only looks like it offers a 2:1 reward-to-risk ratio going out one month from now, but surprisingly, it also lets us short the ATM call spread I want to while collecting 41% of the strike differential to the hedge strike above it that I’ll use (based on yesterday’s closing mid prices).

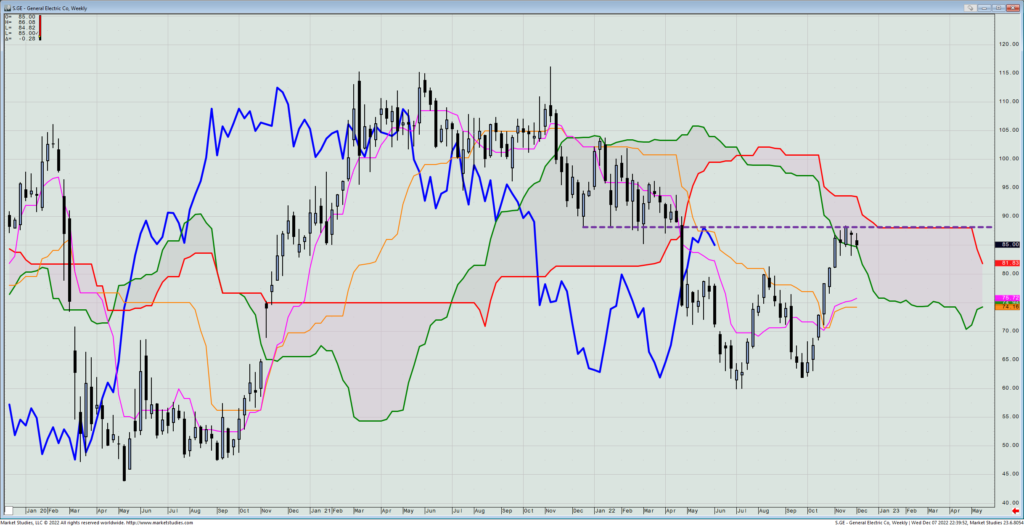

Earlier this year, we had a very successful short play in GE, when prices were much higher. As I have not looked at the name in months, I still had the chart open on one of my hundreds of chart pages. When I came across it today, I saw that the rally off the bottom has stalled right against its prior resistance area (i.e., the dashed horizontal, purple-colored line). I then saw that its weekly cloud bottom starts to dramatically tail off starting next week, and falls to the $75 area about a month from now. Its cloud top – this week at $93.45 – falls over the next four weeks to flatten out to $88, virtually the same level it has so far stopped at on this rally.

GE – Weekly

The way I am looking at this is that going one month out, the likelihood that this can fall to next major support is twice the price decline than what would be lost if it got a breakout above $90. Therefore, this all lines up well to short a GE Jan. 6th $85/$90 call spread today, collecting my desired 40% strike differential credit – and being able to do so even in an environment that I’d really prefer to be buying options (because of cheap volatility cost relative to where it’s been this year).

MS Bullish Trade Adjustment Signal Investment Rationale...

Read More

SCHW Bullish Opening Trade Signal Investment Rationale...

Read More

Closing Trade FSLR Bullish Opening Trade Signal Investment...

Read More

GOOGL Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on