DailyPlay – Portfolio Review – February 9, 2024

DailyPlay Portfolio Review

Investment Rationale

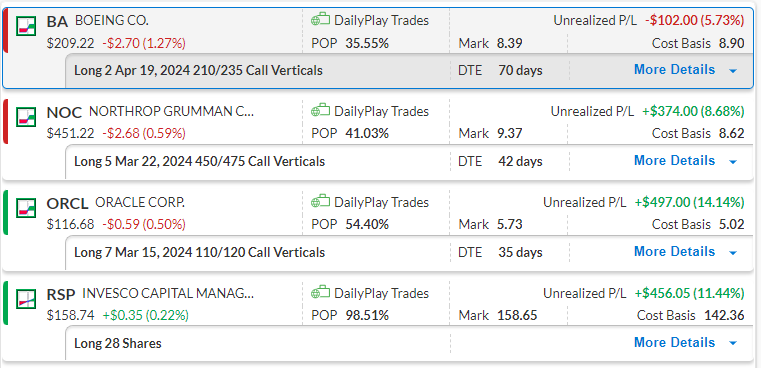

Based on the criteria of our scans, no new trading opportunities have crossed our radar for today. Our four trades are performing according to expectations and we will continue to monitor them for any needed adjustments.

Our Trades

BA

Bullish Debit Spread. This trade was only placed two days ago and a bounce higher is to be expected over the next few trading days.

NOC

Bullish Debit Spread. We added another 2 contracts to our NOC trade as this trade was performing well as price has broken above the $450 level. It is one of our strategies to add more exposure to winning trades, as we did with NOC.

ORCL

Bullish Debit Spread. Our ORCL trade is up by another few percentage points this week, with the next major resistance level is at $120. This trade was essentially a free debit spread as we had rolled up and out from the previous ORCL trade.

RSP

Long-term play on the S&P Equal Weighted Index. Price consolidated in the last 2 weeks but showing bullish price action at the $155 level. We will continue to hold this position.

More DailyPlay

DailyPlay – Opening Trade (MU) – December 04, 2025

MU Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Opening Trade (NVDA) – December 03, 2025

NVDA Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Adjusting Trade (META) – December 02, 2025

META Bullish Trade Adjustment Signal Investment...

Read More

Share this on