DailyPlay – Portfolio Review – August 11, 2025

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

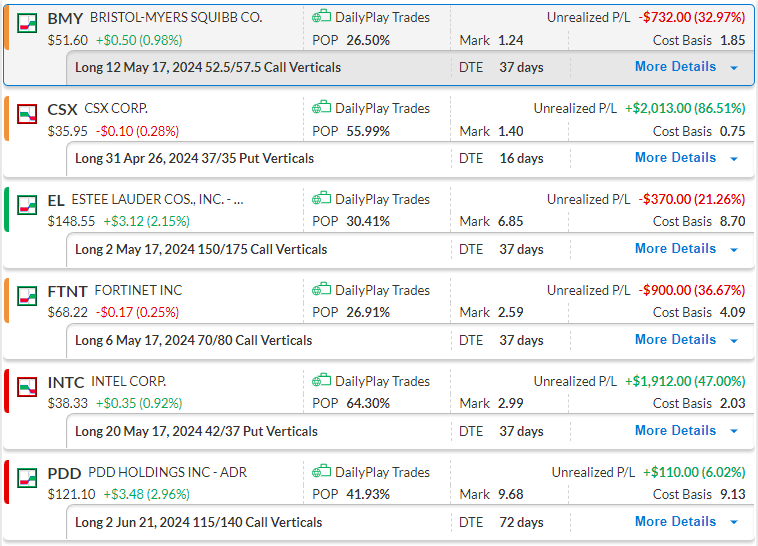

All eyes are on the CPI print today, with bond traders starting to pare back some of the hawkish bets that we’ve seen over the past few weeks. Until we have more clarity from the CPI print, we are going to do without adding additional exposure to our portfolio.

Bullish Debit Spread – We’re just trading around our $51.50 stop loss level, however, it has held this support level and with 38 days left, we intend on holding on to this position for now.

Bearish Debit Spread – Trade has continued to work in our favor towards our $33.50 target price, but is starting to show signs of exhaustion on this selloff and we are on watch for potential Take Profit opportunities.

EL – 37 DTE

Bullish Debit Spread – After a poor start, EL is starting to outperform the markets again, and with 38 days left, we will continue to hold onto this position.

FTNT – 37 DTE

Bullish Debit Spread – Still holding its $67 support level and with 38 days left to expiration, we will continue to hold and monitor this position.

INTC – 37 DTE

Bearish Debit Spread – This trade is working well and we have already added exposure to this position, our downside target is $34.50, and look to take profits around that area.

PDD – 72 DTE

Bullish Debit Spread – We just entered this trade yesterday and working well as Chinese internet stocks are showing strength and momentum.

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on