DailyPlay – Portfolio Review – August 11, 2025

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

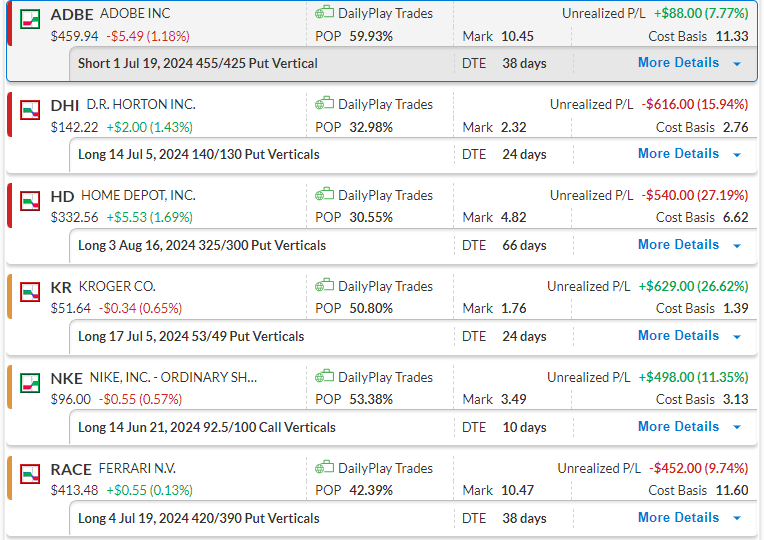

Apple’s WWDC event seems to have disappointed investors looking for a knockout AI integration into iOS18. Spending only 2 mins on their partnership with OpenAI’s ChatGPT into Siri, AAPL sold off yesterday and opening up today even lower. Overall, it’s a step in the right direction, but AAPL remains behind their rivals on the software side for AI. As we turn towards the CPI print and the FOMC meeting later this week, let’s review our DailyPlay positions.

Bullish Credit Spread – Earnings are slated for Thursday PM and holding below $460 resistance at the moment, will consider closing before the earnings event.

Bearish Debit Spread – Just sitting above $140 major support with poor relative performance, suggesting possible major breakdown.

Bearish Debit Spread – Trading just above its major $330 support/resistance level, we’re looking for further weakness towards a $305 downside target.

Bearish Debit Spread – Now within $1 of filling its gap at $50.60, with extended targets of $47 to the downside.

Bullish Debit Spread – Has broken above $95 resistance, looking for a continuation towards the $100 upside target.

Bearish Debit Spread – Still trading near the bottom end of the range and we’re looking for a break below towards a $390 downside target.

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on