DailyPlay – Adjusting Trade (GS) & Closing Trade (FSLR, CRWD) – August 08, 2025

Closing Trade GS Bullish Trade Adjustment Signal...

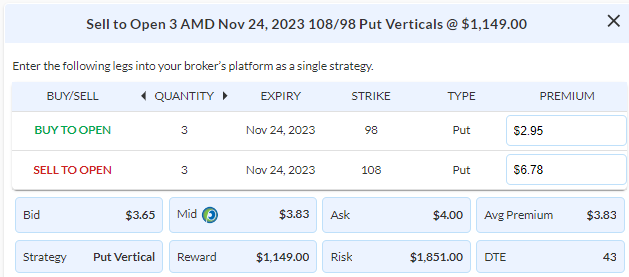

Read MoreStrategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 3 Contracts Nov 24th $108/$98 Put Vertical Spreads @ $3.83 Credit per contract.

Total Risk: This trade has a max risk of $1,851 (3 Contracts x $617) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $617 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a Bullish trade on a stock that found support and is expected to bounce higher.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

OptionsPlay Score: 91

Stop Loss: @ $7.65 Debit (100% loss of premium collected)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

As the AI hype starts to fizzle out, comes opportunity as initial stocks that were bid up trade back to more reasonable levels. This gives us an opportunity to add some long exposure with more favorable risk/reward ratios. AMD, which expects to ship around 10% of the AI chips that market leader NVDA is the underdog to bet on with the recent pullback. With over 700% growth in their AI chips shipped in Q2, AMD is likely to cement itself as the 2nd largest AI chips supplier globally. Trading at 26x forward earnings, it trades at substantial discount to NVDA and the pullback to its $100 support level provides favorable timing to add long exposure now. As implied volatility on AMD is still very elevated, we’ll start with selling the Nov 24 $108/$98 Put Vertical @ $3.83 Credit. With a hypothetical portfolio of $100,000, I recommend risking 2% of the portfolio’s value to this trade, which is 3 Contracts for a risk of $1,851. We will set a stop loss on the put spread at around 100% of the premium collected @ $7.65 Debit.

AMD – Daily

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read More

Share this on