DailyPlay – Adjusting Trade (GS) & Closing Trade (FSLR, CRWD) – August 08, 2025

Closing Trade GS Bullish Trade Adjustment Signal...

Read MoreStrategy: Short Put Vertical Spread

Direction: Bullish

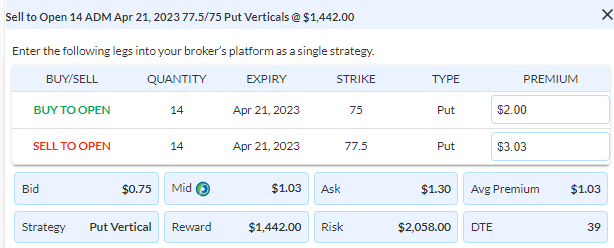

Details: Sell to Open 14 Contracts April 21st $77.50/$75 Put Vertical Spreads @ $1.03 Credit per contract.

Total Risk: This trade has a max risk of $2,058 (14 Contracts x $147) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $147 to select the # contracts for your portfolio.

Counter Trend Signal: This stock is currently trading lower but is expected to bounce higher from support.

1M/6M Trends: Bearish/Bearish

Technical Score: 3/10

OptionsPlay Score: 85

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Friday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Stocks got rocked on Friday as the SVB story got worse, and California shut the bank. Regional bank stocks were walloped for significant losses, and all the mess dragged ths SPX down to 3862 – two points beneath the key support level I’ve targeted for a few weeks already as what needs to hold up to reduce the odds increasing of a test of the 2022 lows. Two points is just two close to make the call, but with last week’s downmove already qualified (by a lower Friday close two weeks ago relative to three Fridays ago), if this week sees a lower open on Monday morning; a lower low this week beneath last week’s low; and a lower Friday close relative to last Friday – we’d get a qualified and confirmed breakdown of that weekly bearish Propulsion Momentum level of 3864, with a Prop. Exhaustion level measured to 3532 (essentially, by chance, last year’s low area).

As I write this Sunday night, I see S&P futures up 50 points from their 4:15 settlement on Friday. This is no surprise, given just how close the SPX hugged that very important support level on Friday’s close. (If today doesn’t open lower at 9:30am, then the bearish Prop. Momentum signal cannot be made this Friday, regardless of how the market trades this week.) So, those who are in the bull camp got their ideal entry point right on the close Friday.

I’ve declared that we are likely in a trading range, bounded by approx. 4148 on the top and 3864 on the bottom. We’ve now seen both those levels trade in the past six weeks, so right now, we’ve got the main resistance and support levels pegged correctly.

I’m still in the camp that the market will likely ultimately head lower to test those 2022 lows – mostly from my belief that earnings revisions will fall sharply before all is said and done. And that will not come while seeing stocks hang out near being unchanged on the year; they will fall on those earnings estimates downward revisions when analysts realize that “The king has no clothes”.

We are up 32% on our short SPOT call spreads. They expire on Friday this week. Let’s take off 3 of 7 today.

We are up 99% on our long GLD trade. Let’s exit 2 of 6 of the long call spreads today.

We are up 49% on our long CLX put spreads. Let’s exit 2 of 8 of them today.

For a new trade idea, let’s play for a quick trading bounce in beaten down Archer Daniels Midland (ADM) as it had an active daily Sequential -13 signal from early March that has slid to its Risk level while also marking a new Combo -13 signal on Friday. Calls are too pricey, so let’s look to sell the April 21 $77.5/$75 put spread for what was priced on Friday’s close at $1.03 mid. It collects 41%.

ADM– Daily

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read More

Share this on