DailyPlay – Portfolio Review – August 11, 2025

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read MoreInvestment Rationale

Stocks traded in a fairly narrow range yesterday, waiting for the FOMC minutes, which when they came out, did nothing material to the market. That puts the key earnings coming out today and tomorrow as the main catalyst for how stocks will trade the next two days – and possibly well after that.

In the meantime, the SPX is right by the 2022 lows made earlier this week. Many are looking for the growing number of daily Sequential -13s to indicate a rally is coming. I’m not pressing the downside bets hear and now, but will look for clues for the next 100- to 150-point move to try to take advantage of. I’m still thinking that we can see the mid-3400s trade this month, but it’s getting harder to play for an ~ 120-pt. downmove when we’d now need risk more than that on the upside.

Tomorrow the last remaining 1 spread we have on in TLT expire. Make sure you are out of them today.

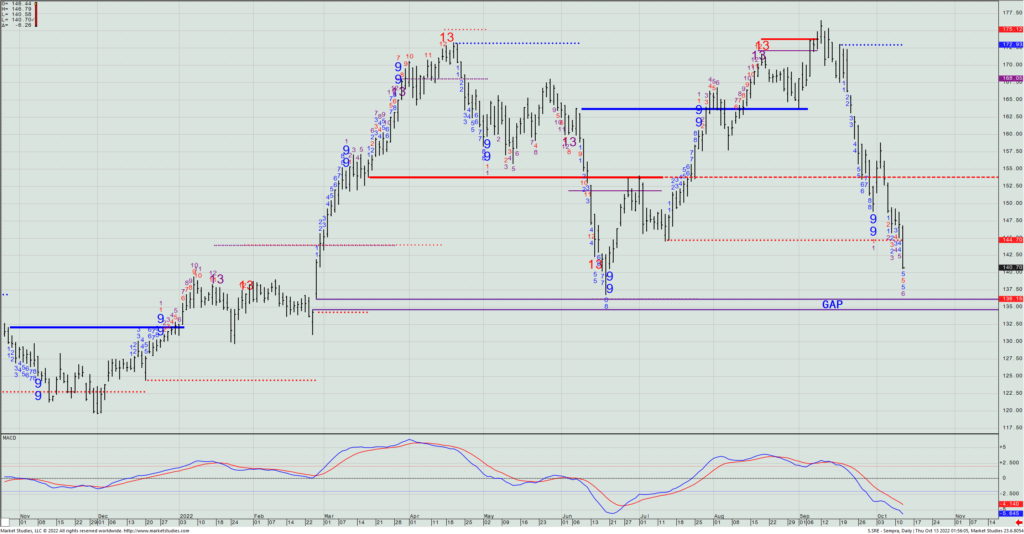

Also, we have 2 remaining long put spreads in SRE that expire in 8 days. We’ve got a huge win on this trade, with these final two spreads trading at about 4x the price we paid for them. Should we see a move to the $136 to $135 take place in the next few trading days, we’ll exit the balance of the trade at the then current mid-price of the Oct. 21st $165/$145 put spread as it fills the gap area I have on the below chart.

SRE – Daily

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on