DailyPlay – Portfolio Review – August 11, 2025

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read MoreStrategy: Long Put Vertical Spread

Direction: Bearish

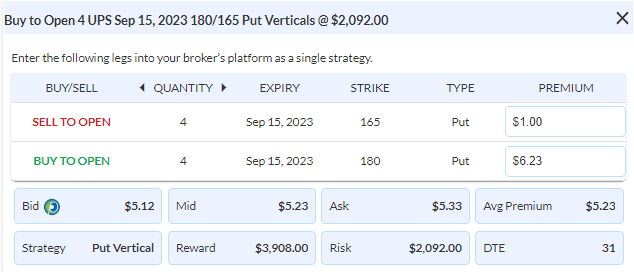

Details: Buy to Open 4 Contracts Sept 15th $180/$165 Put Vertical Spreads @ $5.23 Debit per contract.ct.

Total Risk: This trade has a max risk of $2,092 (4 Contracts x $523) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $523 to select the # shares for your portfolio.

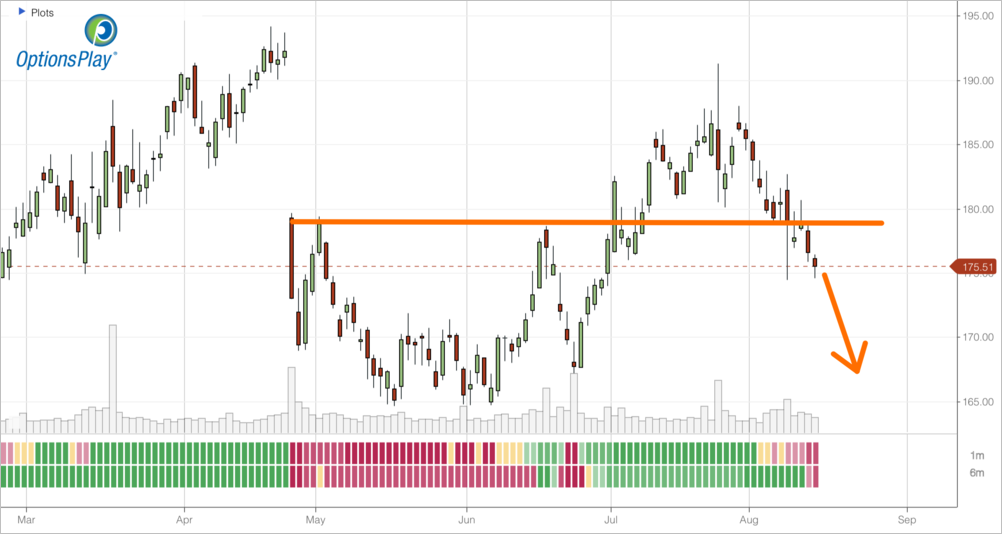

Trend Continuation Signal: This stock is in a bearish trend and is expected to continue this trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 4/10

OptionsPlay Score: 134

Stop Loss: @ $2.60 Credit (50% loss)..

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Investment Rationale

Our goal with the DailyPlay trading signals is to show you how to trade ideas for profitability. This entails two primary rules that we must stay 100% disciplined in, cutting losses quickly and adding exposure when a trade starts to work in our favor to potentially hit home runs. Today, we get to exercise both disciplines with LYFT and UPS. When a trade such as LYFT does not go in the direction that we expect, instead of holding and hoping it turns back into a profit, it is far better to take a small loss, accept it and move on. Moreover, with our UPS position, the market has proven our initial outlook correct. Instead of taking a small profit, we will add more exposure to the trade. This may be counter to what you want to do, but the road to profitability requires us to take bigger bets at times, and it’s when the market proves our outlook to be correct, that we have the best shot of hitting home runs. We are going to add to our UPS short position by adding another 2% of our portfolio’s value to the trade. Buy Sept $180/165 Put Verticals @ $5.23 Debit. With a hypothetical portfolio of $100,000, adding another 2% of risk on this trade would be 4 Contracts for an additional $2,092 of risk. We will move our stop loss on the entire position to 50% of the premium paid, $2.60 Credit.

UPS – Daily

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on