DailyPlay – Closing Trade (FDX) & Portfolio Review – October 13, 2025

Closing Trade DailyPlay Portfolio Review Our Trades C...

Read More

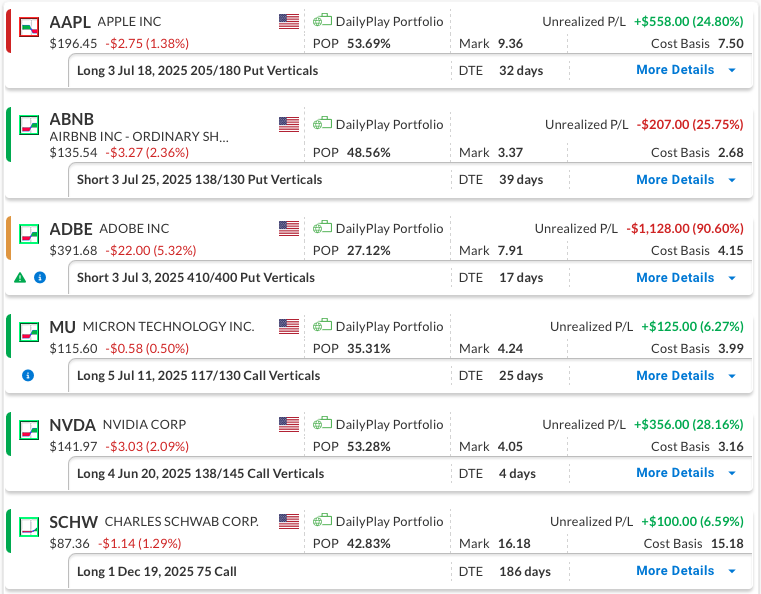

AAPL – 32 DTE

Bearish Debit Spread – Apple Inc. (AAPL) – Apple’s stock showed weakness last week, with signs of modest downside pressure emerging. AAPL still trades at a premium to its peers, and ongoing concerns about tariffs and trade dynamics remain a factor. With sufficient time until expiration, we are holding the position to allow the trade thesis to continue to play out.

ABNB – 39 DTE

Bullish Credit Spread – Airbnb Inc. (ABNB) – We recently entered this position. The stock was down this week with the general direction of the market and we plan to hold our course at this time.

ADBE – 17 DTE

Bullish Credit Spread – Adobe Inc. (ADBE) – Adobe’s Q2 results met expectations with a modest beat and upward guidance revision. However, investor sentiment turned cautious, sending the stock down 5.32% post-announcement, bringing it close to our max loss. We believe the underlying fundamentals remain favorable and are maintaining the trade following earnings. While the stock’s reaction warrants attention, we continue to see enough strength to justify holding the position, though we’ll monitor the trend closely.

MU – 25 DTE

Bullish Credit Spread – Micron Technology, Inc. (MU) – We recently entered this position. The stock had a solid week despite a challenging overall market, and we plan to hold our course at this time. The company is set to report earnings on Wednesday, June 25th, after market close.

NVDA – 4 DTE

Bullish Debit Spread – Nvidia Corp. (NVDA) – Since the earnings announcement, this trade has hovered near breakeven, fluctuating between small gains and losses. With NVDA showing some weakness last week and expiration approaching quickly, we’re likely to close the position early this week to manage risk effectively.

SCHW – 186 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – Our outlook remains positive, supported by strong company fundamentals and continued strength in both SCHW and the broader financial sector.

Closing Trade DailyPlay Portfolio Review Our Trades C...

Read More

C Bullish Opening Trade Signal Investment Rationale...

Read More

FDX Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on