DailyPlay – Opening Trade (MS) – July 15, 2025

MS Bullish Opening Trade Signal Investment Rationale...

Read MoreInvestment Thesis

Alphabet Inc. (GOOGL) remains well-positioned ahead of its upcoming earnings release on Wednesday, July 23rd, after market close. Despite ongoing regulatory challenges, the company continues to deliver strong operational performance and strategic execution across its core businesses. Its AI integration across search, cloud, and emerging technologies positions it for sustained double-digit growth, while its $70 billion buyback authorization and growing dividend provide immediate shareholder returns. Overall, Alphabet’s combination of scale, innovation, and capital returns underpins a constructive outlook for the stock in the second half of 2025.

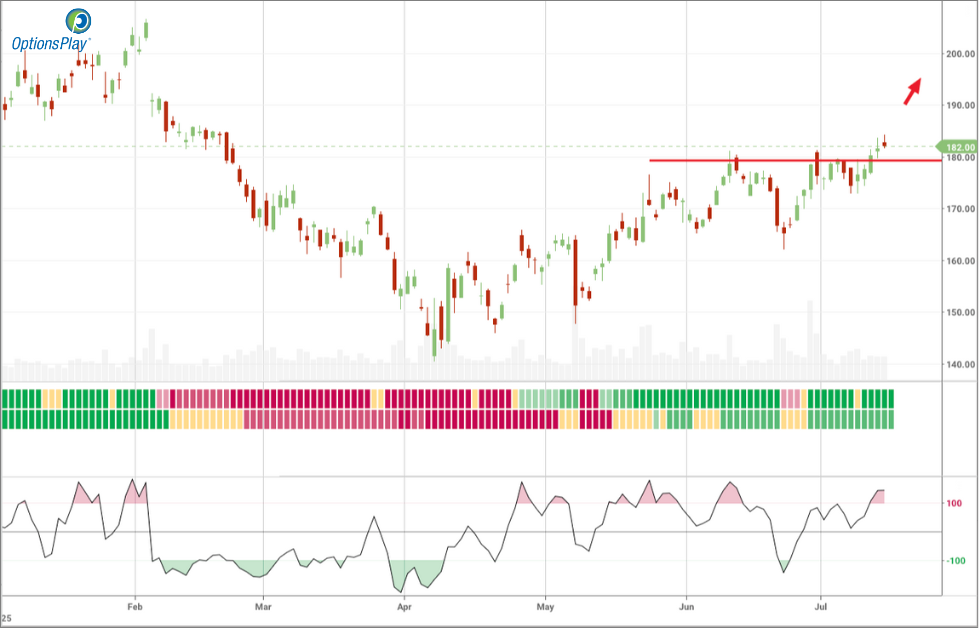

Technical Analysis

The recent price action of Alphabet Inc. (GOOGL) suggests that bullish momentum is building. The stock is trading above its 200-day moving average, indicating a long-term uptrend. The 20-day moving average has crossed above the 200-day moving average, forming a golden cross, which is a bullish signal. The Relative Strength Index (RSI) is at 58, suggesting room for further upward momentum without being overbought. Additionally, the recent breakout above resistance at $175.34 has been accompanied by strong volume, highlighting solid buying interest. These technical factors point to a bullish trajectory for GOOGL as the company approaches its earnings release.

Fundamental Analysis

Alphabet’s valuation remains attractive, trading slightly below the industry median despite its superior profitability profile. Robust expected EPS and revenue growth highlight the strength of its diversified business model, while net margins well above peers demonstrate strong operating leverage and disciplined capital allocation. Management’s ability to maintain elevated margins amid regulatory and macro headwinds reinforces Alphabet’s position as a durable, high-quality compounder with significant long-term upside potential.

Options Trade

Consider the August 29th 180/210 call vertical for $867. This trade risks $867 to potentially gain $2,133 if GOOGL closes above $210 at expiry, offering an attractive 2.5:1 reward-to-risk setup. The vertical spread structure provides defined risk while benefiting from potential earnings momentum and longer-term AI-driven growth catalysts.

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 2 GOOGL Aug 29 $180/$210 Call Vertical Spreads @ $8.67 Debit per Contract.

Total Risk: This trade has a max risk of $1,734 (2 Contracts x $867) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $867 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 4/10

OptionsPlay Score: 100

Stop Loss: @ $4.34 (50% loss of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

MS Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay Portfolio Review Our Trades GS – DTE...

Read More

ABNB – 0.37% loss: Buy to Close 3 Contracts (or 100%...

Read More

GS Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on