DailyPlay – Conditional Opening Trade (SPY) Partial Closing Trade (GE) – December 16, 2022

Partial Closing Trade

- GE – 81.12% Gain: Buy to Close 3 Contracts Jan. 6th $85/$90 Call Vertical Spreads @ $0.37 Debit. DailyPlay Portfolio: By Closing 3 of the remaining 6 Contracts, we will be paying $111.

SPY Conditional Bearish Opening Trade

View SPY Trade

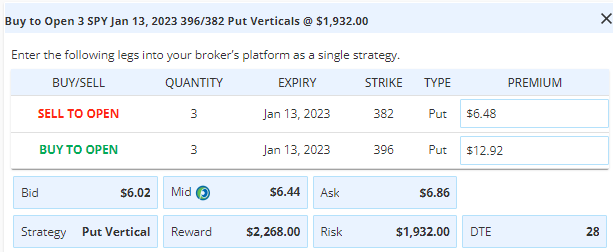

Strategy Details

Strategy: Long Put Vertical Spread

Direction: Bearish

Details: Buy to Open 3 Contracts Jan. 13th $396/$382 Put Vertical Spreads @ $6.44 Debit.

Total Risk: This trade has a max risk of $1,898 (3 Contracts x $644).

Trend Continuation Signal: This is a Bearish trade on a stock that is experiencing a mildly bearish trend.

1M/6M Trends: Mildly Bearish /Neutral

Technical Score: 8/10

OptionsPlay Score: 109

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note that this is a CONDITIONAL trade. We will only enter the trade when the condition is met, which is IF SPY RALLIES TO THE $395/$398 AREA. Also note that the cost basis, premium paid, as well as the number of contracts when we open this trade will therefore be different from what we post today. This condition is only valid for a week unless advised otherwise.

Investment Rationale

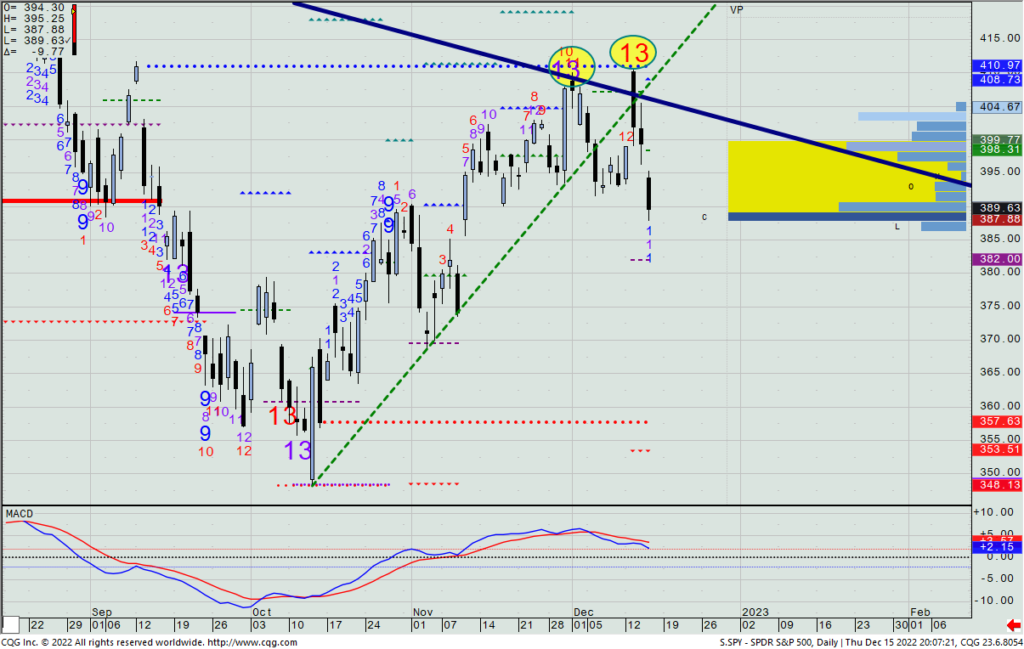

Yesterday’s decline was a real game-breaker for the longs, as more investors came to grips with what I have been saying all along: The Fed wasn’t going to budge their message into a dovish stance (that bulls were looking for), and the rally that started in mid-October has likely come to a sudden end – at least for now.

Yesterday, I covered half of my very large short position that I put on after Tuesday’s CPI surge, and will look to cover more when/if the SPX declines into the unfilled gap area from 3860 to 3818. (This is for a fund that I am a PM for.)

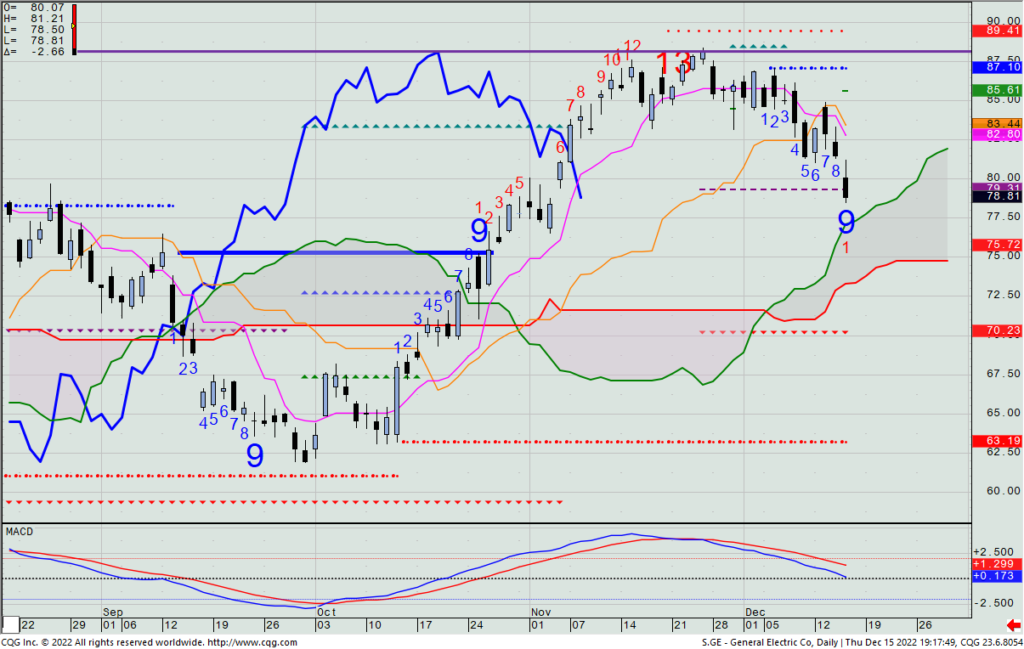

As for today, I want to trim some of the short GE Jan. 6th $85/$90 call spread that we have. We originally sold 8 spreads; took 2 off when he hit a 50% profit within 4 days of holding it, and now with a daily Setup -9 against the bearish Propulsion Momentum level, I want to exit 3 more of the remaining six spreads, as we’re up 81% on these.

GE – Daily

Yesterday, I suggested selling a WBA Dec. 30th $41.5/$42.5 call spread IF we saw price rally up to $41.45 by Tuesday. That now looks far less likely to happen given the decline to the bottom of its four-week range yesterday. I will reset this idea to now look to short the $40.5/$41.5 call spread (same expiration) if price gets back up to $40.5 by this coming Wednesday’s close.

WBA – Daily

Lastly, as a new idea, should we see the SPY trade up to the $395 to $398 area in the next few days, we’ll look to buy the Jan. 13th $396/$382 put spread for what is then its bid/offer mid price. THIS IS A CONDITIONAL TRADE NEEDING A SPY RALLY TO THE $395/$398 AREA TO IMPLEMENT.

SPY – Daily

More DailyPlay

DailyPlay – Opening Trade (MU) – December 04, 2025

MU Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Opening Trade (NVDA) – December 03, 2025

NVDA Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Adjusting Trade (META) – December 02, 2025

META Bullish Trade Adjustment Signal Investment...

Read More

Share this on