DailyPlay – Opening Trade (SPOT) – October 14, 2025

SPOT Bearish Opening Trade Signal Investment Rationale...

Read MoreInvestment Thesis

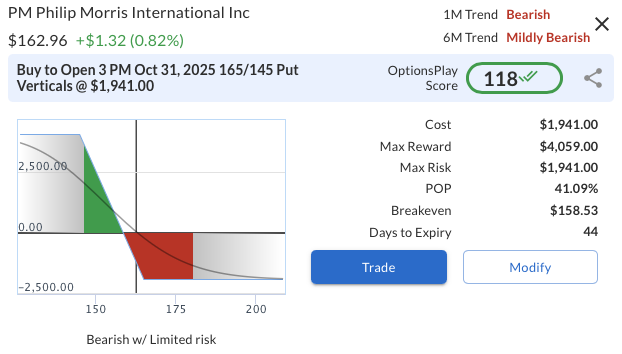

Philip Morris International (PM) is showing signs of weakness as both technical and fundamental dynamics point to a more challenging backdrop. While the company remains a global leader in reduced-risk products and traditional tobacco, its elevated valuation and margin pressures leave little room for error. With price action stalling and momentum indicators rolling over, downside risks appear to be gaining traction. Against this backdrop, a defined-risk options strategy provides an efficient way to express a bearish view while limiting capital at risk.

Technical Analysis

On the daily chart, PM is consolidating, suggesting a potential reversal from its prior uptrend. The $161 area has been repeatedly tested and shows early signs of weakness on declining volume, indicating rising selling pressure. Technical indicators point to a bearish bias: the RSI sits at 43.2, below the neutral 50 level, while both the 20-day and 50-day moving averages are turning downward, with the 50-day acting as resistance recently. A decisive break below $161 would confirm a downward move. Until then, the setup favors cautious or bearish positioning, particularly as fundamentals continue to soften.

Fundamental Analysis

Philip Morris trades at a premium relative to its industry peers while delivering weaker margins, raising questions about sustainability if growth expectations falter. Revenue and EPS growth projections remain stronger than the industry median, but valuation and profitability leave the stock exposed should sentiment deteriorate further.

Options Trade

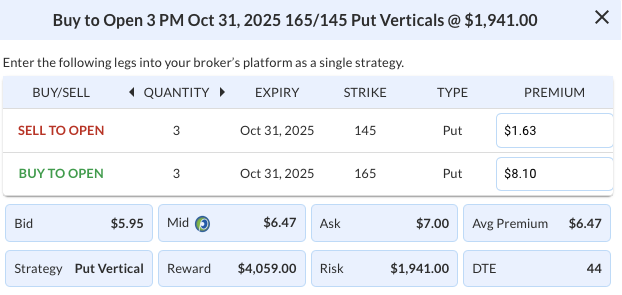

A put vertical spread offers defined risk and favorable leverage to the downside. The suggested trade is to buy the Oct 31, 2025 $165 put and sell the $145 put for a net debit of $6.47 ($647 per spread). This structure risks $647 while offering a maximum reward of $1,353 if PM closes at or below $145 at expiration. The reward-to-risk ratio of roughly 2.1:1 makes the setup attractive. This approach provides efficient bearish exposure without the unlimited risk of outright shorting.

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

Details: Buy to Open 3 PM Oct 31 $165/$145 Put Vertical Spreads @ $6.47 Debit per Contract.

Total Risk: This trade has a max risk of $1,941 (3 Contracts x $647) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $647 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower over the duration of this trade.

1M/6M Trends: Bearish/Mildly Bearish

Relative Strength: 4/10

OptionsPlay Score: 118

Stop Loss: @ $3.24 (50% loss of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

SPOT Bearish Opening Trade Signal Investment Rationale...

Read More

Closing Trade DailyPlay Portfolio Review Our Trades C...

Read More

C Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on