DailyPlay – Opening Trade (WMT) – November 18, 2025

WMT Bearish Opening Trade Signal Investment Rationale...

Read More

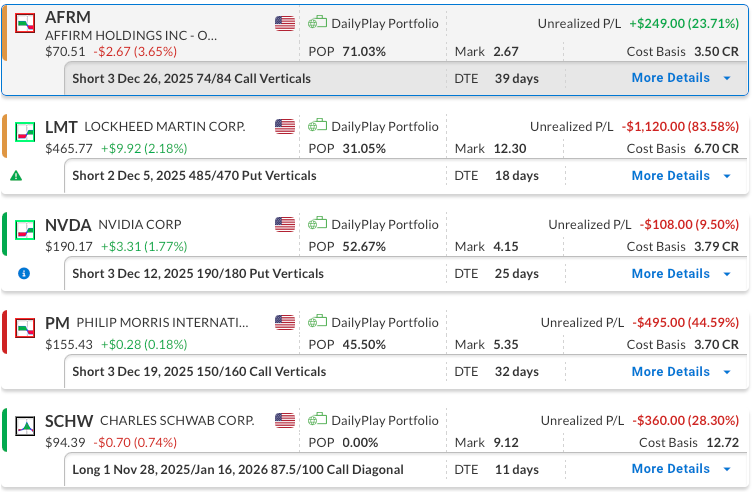

Our Trades

AFRM – 39 DTE

Bearish Credit Spread – Affirm Holdings Inc. (AFRM) – We recently established this position and plan to maintain it for now. Affirm reported solid Q3 results, with a beat on the top and bottom line, which helped move the stock higher initially. However, valuation remains a concern, as the stock trades at a high price-to-earnings ratio of 108.45x, raising questions about the durability of its long-term growth expectations.

LMT – 18 DTE

Bullish Credit Spread – Lockheed Martin Corp. (LMT) – This position gave up its recent gains following the company’s strong earnings report. The primary driver had been concerns over the US government shutdown, the longest in history, which led to delays in defense contracts, budget approvals, and payments for contractors like LMT. With the shutdown now over, the stock is building upside momentum, and we plan to hold the position, expecting that LMT could continue to rebound, though there is still some risk with expiration nearing.

NVDA – 25 DTE

Bullish Credit Spread – NVIDIA Corporation (NVDA) – We recently established this position and plan to maintain it for now. The company is set to report earnings on Wednesday, November 19, after the close.

PM – 32 DTE

Bearish Credit Spread – Philip Morris (PM) – our outlook remains bearish as transition growth slows, margins compress, and regulations tighten. The recent rally bumped against the 50-day moving average and then retreated, pointing to a potential near-term pullback. We will maintain the position in the short term with ample time until expiration.

SCHW – 11 DTE & 60 DTE

Bullish Diagonal Debit Spread – Charles Schwab Corp. (SCHW) – We remain bullish on the stock. After realizing gains on our initial long call, we rolled into a higher strike with a longer expiration and later sold a short-term out-of-the-money call to lower our cost basis. The short option’s expiration is approaching.

WMT Bearish Opening Trade Signal Investment Rationale...

Read More

AFRM Bearish Opening Trade Signal Investment Rationale...

Read More

NVDA Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on