DailyPlay – Portfolio Review – August 11, 2025

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

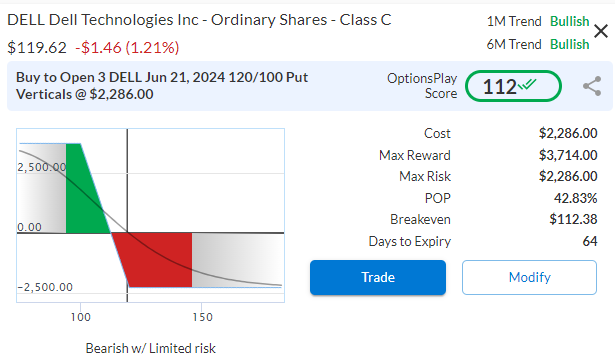

Read MoreDELL has taken off on the back of AI hype over the past year and trades at its all-time highs both in terms of price and valuation. The question is, are these justified given their future potential? My concern is that the fundamentals just do not seem to add up and the chart is starting to show signs of exhaustion. This warrants a potential pullback as investors rethink equity valuations as 10-year yields shoot towards 5%.

Technical Analysis

DELL recently gapped higher and formed a double top at $130 with signs of exhaustion from the negative divergence. It currently leaves a gap of $95 that remains unfilled and is our downside target after its $105 support level.

DELL – Daily

Fundamental Analysis

While DELL may seem cheap at only 16x forward earnings with AI as a tailwind, EPS growth is only expected in the single digits and for revenues to be flat. When we couple such underwhelming growth rates with Net margins of only 5%, 16x earnings no longer seems cheap. On the contrary, DELL traded at only 6x forward earnings just 2 years ago, with its historical 10-year average just under 9x. By all other accounts, DELL looks expensive now that it has been inflated by AI hype.

Strategy: Long Put Vertical Spread

Direction: Bearish Debit Spread

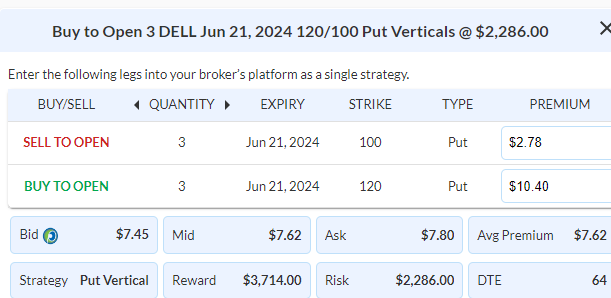

Details: Buy to Open 3 Contracts June 21st $120/$100 Put Vertical Spreads @ $7.62 Debit.

Total Risk: This trade has a max risk of $2,286 (3 Contracts x $762) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $762 to select the # contracts for your portfolio.

Counter Trend Signal: This is a bearish trade on a stock that is overbought and expected to pull back.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 112

Stop Loss: @ $3.81 Credit. (50% loss of premium paid)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

Please note that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

DailyPlay Portfolio Review Our Trades GOOGL – 25 DTE...

Read More

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on