DailyPlay – Opening Trade (QCOM) – July 17, 2025

QCOM Bullish Opening Trade Signal Investment Rationale...

Read MoreAdjustment Rationale:

Our bearish outlook on Tesla, Inc. remains intact. A “Bearish Trend Following” alert was recently triggered in the OptionsPlay platform, highlighting that Tesla’s recent rally occurred within a longer-term downtrend, offering a potentially favorable risk/reward setup for a bearish trade. We are maintaining our position as the stock tests key moving averages (20-, 50-, and 200-day) and continues to consolidate in a narrow range. Trading volume remains light, suggesting caution ahead of Tesla’s earnings report, scheduled for Wednesday, July 23rd, after the market closes. With 21 days left until expiration, we plan to manage risk proactively by rolling the short leg of the spread up in strike for a net credit, helping to reduce overall exposure. We will continue to monitor price action closely as earnings draw near.

Adjustment Trade

TSLA @ $319.41

Days to Expiration (DTE): 21

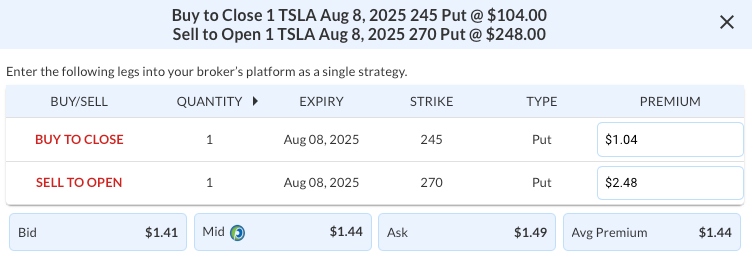

BUY TO CLOSE 1 Aug 08, 2025 245 Put @ $1.04

SELL TO OPEN 1 Aug 08, 2025 270 Put @ $2.48

Mid: $1.44

Premium Received: $1.44 net credit

or $144.00 for the adjustment trade

Strategy: Rolling a Short Put option up in strike

Direction: Resulting in a new Bearish Debit Spread

Details: Buy to Close 1 TSLA Aug 08 $245 Puts @ $1.04 and Sell to Open 1 TSLA Aug 08 $270 Puts @ $2.48

Total Risk: The resulting position has a maximum risk of $1,512 (1,656-144), calculated as the initial cost basis of the spread purchased ($1,656) minus the premium received from the adjustment ($144)

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower off a recent area of resistance.

1M/6M Trends: Neutral/Neutral

Relative Strength: 2/10

Stop Loss: @ $7.56 (50% loss of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

QCOM Bullish Opening Trade Signal Investment Rationale...

Read More

Closing Trade GOOGL Bullish Opening Trade Signal Investment...

Read More

MS Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay Portfolio Review Our Trades GS – DTE...

Read More

Share this on