DailyPlay – Portfolio Review – December 08, 2025

DailyPlay Portfolio Review Our Trades FDX – 25 DTE...

Read MoreThe SPX is still teetering near the 3693 level. Not closing above it today actually locks the weekly Setup -9 signal, and gives a better reason to keep my view that the current low should hold up through Election Day on Nov. 8th.

This morning we’ll see earnings from Verizon, American Express, and Barclays. So far, peers on these three names have done well this reporting season. Today is also a weekly option expiration. The 3700 puts and calls open interest is the highest of any strike nearby, and has well more combined unclosed contracts than the 3650s.

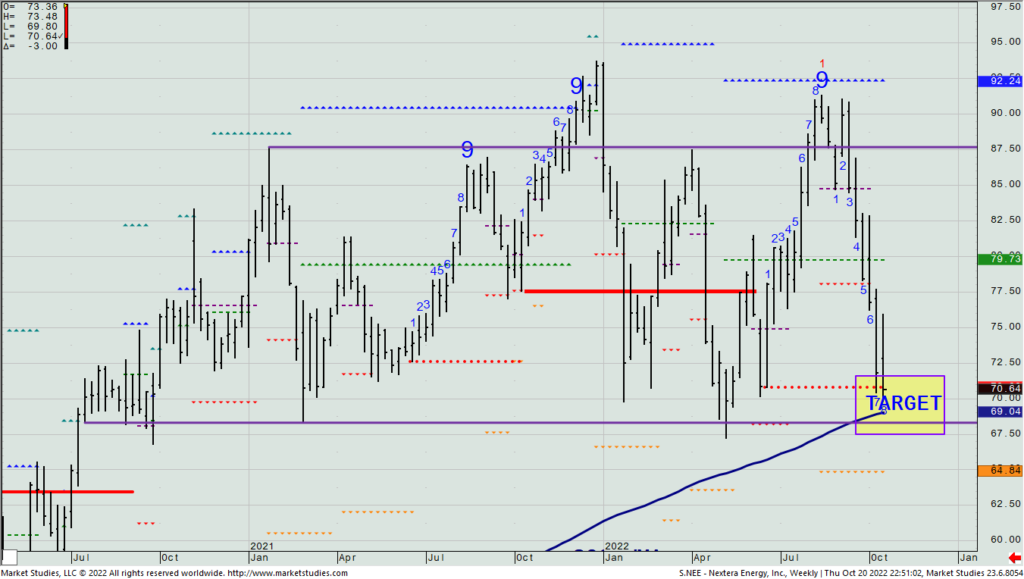

With natgas still selling off, our Nextera short $77.50/$82.50 call spread keeps making more money. Given the decline into what was my target area when I put it on, and it also getting to near its 200-WMA, prior lows, and on a weekly Setup -8 count, I’m going to suggest that we close out the last two spreads today.

NEE – Weekly

DailyPlay Portfolio Review Our Trades FDX – 25 DTE...

Read More

MU Bullish Opening Trade Signal Investment Rationale...

Read More

NVDA Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on