DailyPlay – Portfolio Review – December 08, 2025

DailyPlay Portfolio Review Our Trades FDX – 25 DTE...

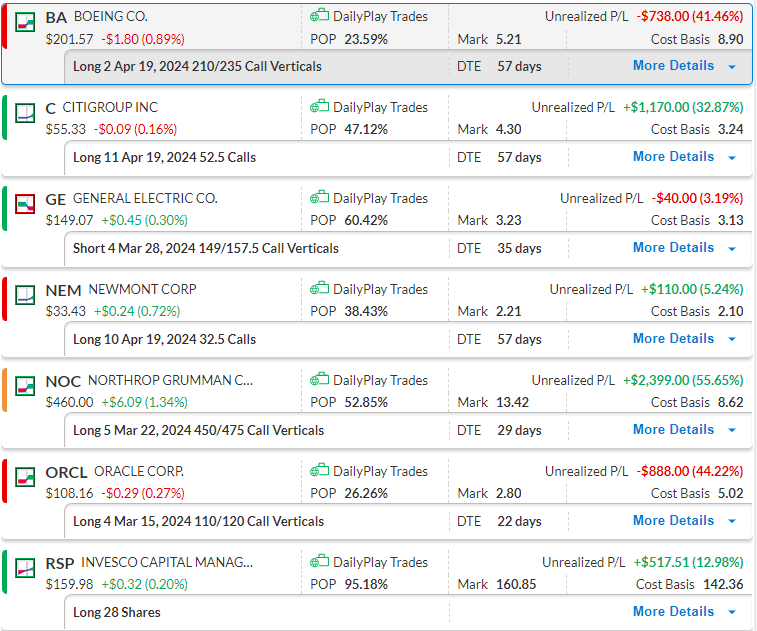

Read MoreRSP broke out above its key resistance at $158.50 but a breakout has not been confirmed by momentum. Let’s take this opportunity to close out this equity trade.

Bullish Debit Spread. Still managing to hold onto $200 support level, but approaching a 50% loss stop-loss level. Keep a close eye on this one today for a potential trigger to close out at stop loss.

Bullish Calls. Looking for the breakout above $55.50 towards $58 initial upside targets, we may get the follow-through today and start realizing some profits on this trade in the next few trading sessions.

Bearish Credit Spread. Just established this yesterday as a fade to its recent strength as GE is extremely overbought and overvalued.

Bullish Calls. Waiting on earnings this morning and looking for a breakout towards $35 and beyond.

Bullish Debit Spread. Nice rally above recent trading range, $463 gap fill looks very likely over the next few trading sessions, where we will be taking profits on this trade.

Bullish Debit Spread. Opening higher today on the back of NVDA earnings, but approaching expiration, and will be looking to close this out over the next couple of trading sessions.

Long-term play on the S&P Equal Weighted Index. We are closing this position today. Please refer to the Closing Trade section at the top of the email as well as the Investment Rationale.

DailyPlay Portfolio Review Our Trades FDX – 25 DTE...

Read More

MU Bullish Opening Trade Signal Investment Rationale...

Read More

NVDA Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on