The AI Infrastructure Inversion: Our New Macro Research Is Live

By Tony Zhang | Chief Strategist,...

Read More

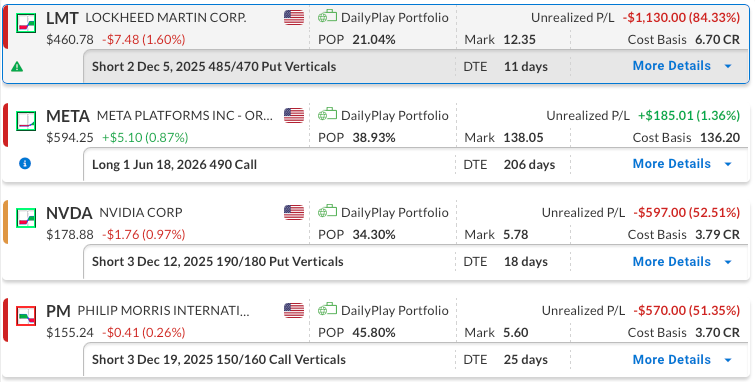

Our Trades

LMT – 11 DTE

Bullish Credit Spread – Lockheed Martin Corp. (LMT) – The US government shutdown had weighed on LMT by slowing defense contracts and budget processes, but following its resolution the stock began to strengthen. Recent market weakness, however, has stalled that momentum. We plan to hold the position, anticipating a potential rebound, yet with expiration fast approaching, we will likely need to exit early in the week unless the stock recovers quickly.

META – 206 DTE

Bullish Long Call, Meta Platforms, Inc. (META), the market dip and META’s pullback provided a favorable setup for a longer term bullish approach. We recently established the position and intend to maintain it for now.

NVDA – 18 DTE

Bullish Credit Spread – NVIDIA Corporation (NVDA) – The company delivered a very strong earnings report and raised guidance. After an initial move higher, the stock reversed as the market chose to sell off. With plenty of time until expiration, we plan to maintain the position for now.

PM – 25 DTE

Bearish Credit Spread – Philip Morris (PM) – our outlook remains bearish as transition growth slows, margins compress, and regulations tighten. The recent rally bumped against the 50-day moving average and then retreated, pointing to a potential near-term pullback. We will maintain the position in the short term with ample time until expiration.

By Tony Zhang | Chief Strategist,...

Read More

💰 The Income Generators (High Probability, Cash...

Read More

💰 The Income Generators (High Probability, Cash...

Read More

💰 The Income Generators (High Probability, Cash...

Read More

Share this on