DailyPlay – Adjusting Trade (GS) & Closing Trade (FSLR, CRWD) – August 08, 2025

Closing Trade GS Bullish Trade Adjustment Signal...

Read MoreAdjustment Rationale:

Our bearish stance on Apple, Inc. (AAPL) remains intact, and we are holding 3 AAPL Jul 18, 2025 205/180 Bear Put Vertical Spreads within the Daily Play portfolio. Apple’s valuation continues to outpace peers, while unresolved trade and tariff risks persist. With the initial trade now at the halfway point to expiration, we’re managing risk by rolling the short 180 put up to the 195 strike, same expiration, for a net credit. Closing the position is also a viable alternative, but the roll effectively keeps the bearish idea in play and reduces the max risk of the position.

Adjustment Trade

Days to Expiration (DTE): 22

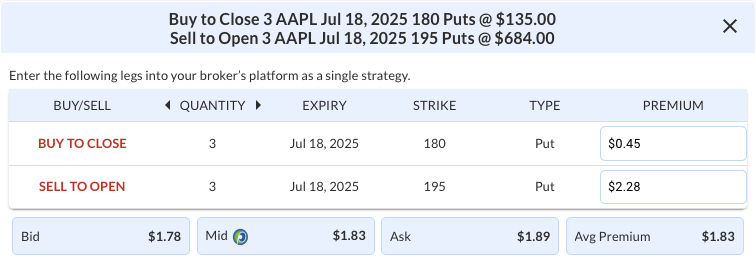

Buy to Close: 3 AAPL Jul 18, 2025 180 Puts @ $0.45

Sell to Open: 3 AAPL Jul 18, 2025 195 Puts @ $2.28

Mid: $1.83

Average Premium Received: $1.83 net credit

or $549 (300 x $1.83) for the adjustment trade

Strategy: Rolling a Short Put option up in strike

Direction: Resulting in a new Bearish Debit Spread

Details: Buy to Close 3 AAPL July 18 $180 Puts and Sell to Open 3 AAPL July 18 $195 Puts @ $1.83

Total Risk: The resulting position has a maximum risk of $1701 (2250 – 549), calculated as the initial cost basis of the 3 spreads purchased ($2250) minus the premium received from the adjustment ($549).

Trend Continuation Signal: This is a bearish trade on a stock that is expected to continue lower off a recent area of resistance.

1M/6M Trends: Neutral/Bearish

Relative Strength: 2/10

Stop Loss: @ $2.84(50% loss of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Closing Trade GS Bullish Trade Adjustment Signal...

Read More

XYZ Bullish Opening Trade Signal Investment Rationale...

Read More

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read More

Share this on