DailyPlay – Adjusting Trade (MS) – August 01, 2025

MS Bullish Trade Adjustment Signal Investment Rationale...

Read MoreThis is a conditional trade idea and the trade should not be taken immediately. Please read the Investment Rationale for more information on this trade. Also, keep in mind that the Credit received, the Max Risk, the Max Reward, as well as the OptionsPlay Score, will be different than what you see in this email, as we are waiting for the price to move more favorably before we enter the trade.

Strategy: Short Put Vertical Spread

Direction: Bullish

Details: Sell to Open 4 Contracts June 13 $292/$285 Put Vertical @ $1.93 Credit.

Total Risk: This trade has a max risk of $2,028 (4 contracts x $507 per contract). As this is a conditional order, the number of Contracts could change depending on the Total Risk at the time of opening the trade. We will base the numbers of Contracts on roughly $2,000 of Risk.

Counter Trend Signal: This is a Bullish strategy on an ETF that is experiencing bearish 1M and 6M trends.

1M/6M Trends: Bearish/Bearish

Technical Score: 4/10

OptionsPlay Score: 91

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Investment Rationale

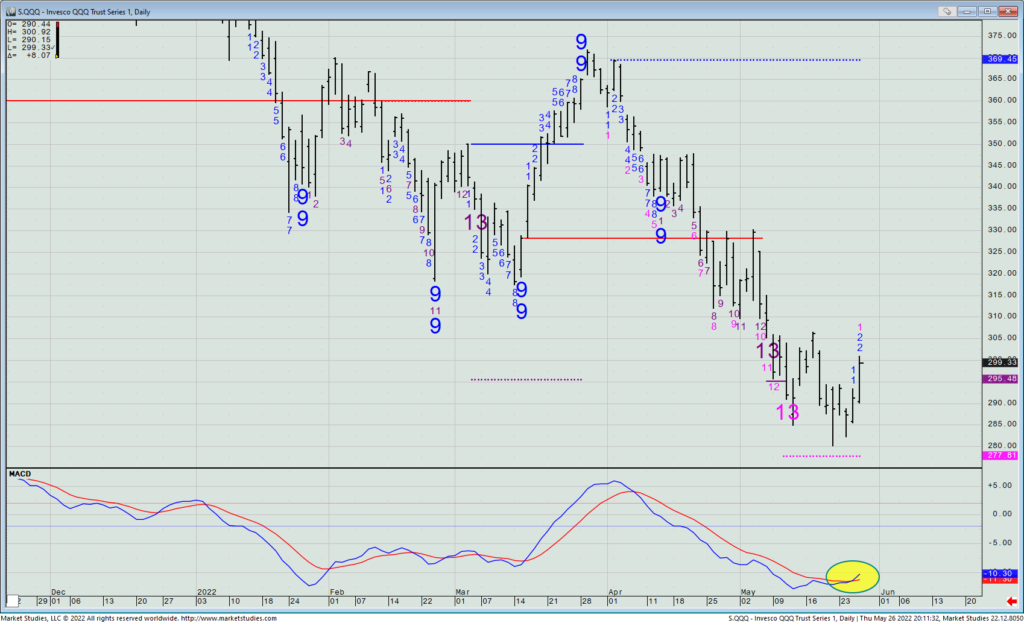

Yesterday saw a strong market rally after NVDA turned itself around after falling sharply after Wednesday’s post-close earnings report/guidance call. The SPX rallied 2%; the NDX 2.8%; and the talking heads on TV are back into bullish mode. Do they have a case?

Well, yes, they do. We’ve been waiting to see if the QQQ weekly cloud model’s Lagging Line was going to hold above its cloud bottom – something it’s been playing with for three weeks. Barring a major down-move today, that support near QQQ $287 is holding, and thus, we will lean bullishly near-term. That being said, I am not going to chase after the up-move on a Friday going into a three-day holiday weekend.

But I am willing to put on a bullish Short Put Spread IF we see the Qs trade down today to ~$295. If we see that, then we’ll look to enter a short June 13th $292/$285 put spread for what on Thursday went out at $1.93. (That credit should be a little higher if/when we’re able to put this on.) That represents about 28% of the strike differential, and gives us downside protection in case new lows come into play.

QQQ – Daily

MS Bullish Trade Adjustment Signal Investment Rationale...

Read More

SCHW Bullish Opening Trade Signal Investment Rationale...

Read More

Closing Trade FSLR Bullish Opening Trade Signal Investment...

Read More

GOOGL Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on