DailyPlay – Opening Trade (GILD) – August 29, 2025

GILD Bullish Opening Trade Signal Investment Rationale...

Read MoreStrategy: Long Call Vertical Spread

Direction: Bullish

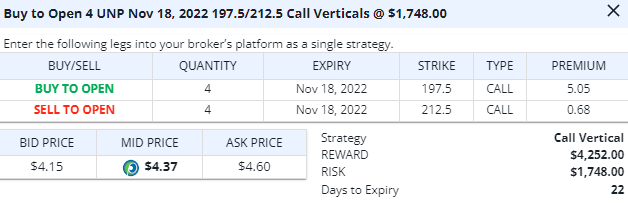

Details: Buy to Open 4 Contracts Nov. 18 $197.50/212.50 Call Vertical Spreads @ $4.37 Debit.

Total Risk: This trade has a max risk of $1,748 (4 Contracts x $437).

Counter Trend Signal: This is a Bullish trade on a stock that is experiencing a bearish trend.

1M/6M Trends: Bearish/Bearish

Technical Score: 3/10

OptionsPlay Score: 93

Use the following details to enter the trade on your trading platform. Please note that if there is a multi-leg option strategy, it should be entered as a single trade.

Please note these prices are based on the previous day’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry. This will be reflected in the Portfolio tab within the OptionsPlay platform.

Investors had a weak dollar and strengthening bonds to give a positive spin to yesterday’s price action, but MSFT and Alphabet earnings reports/guidance more than offset those potential tailwinds. We’ve still got AMZN, AAPL, MA, MRK, MCD, TMUS, and Samsung and Shell earnings reports today, and other big cap names coming shortly to see if I’m right that stocks can hold up into (and possibly beyond) Election Day.

You’ll see that we completely removed commodity-related shorts (e.g., NEE and SLV) as I’ve anticipated dollar weakness which is playing out. And I’ve recently only been only playing bullish stock positions (until yesterday’s short play in AiG), as I was bullish from mid-October into elections on 11/08. I’m trying not to be too committed to either direction right now, but playing with near-term ideas while trying not to be prognosticating out several months. Lots of things are going on – both here and abroad – to keep me from stubbornly sitting with positions that just aren’t working.

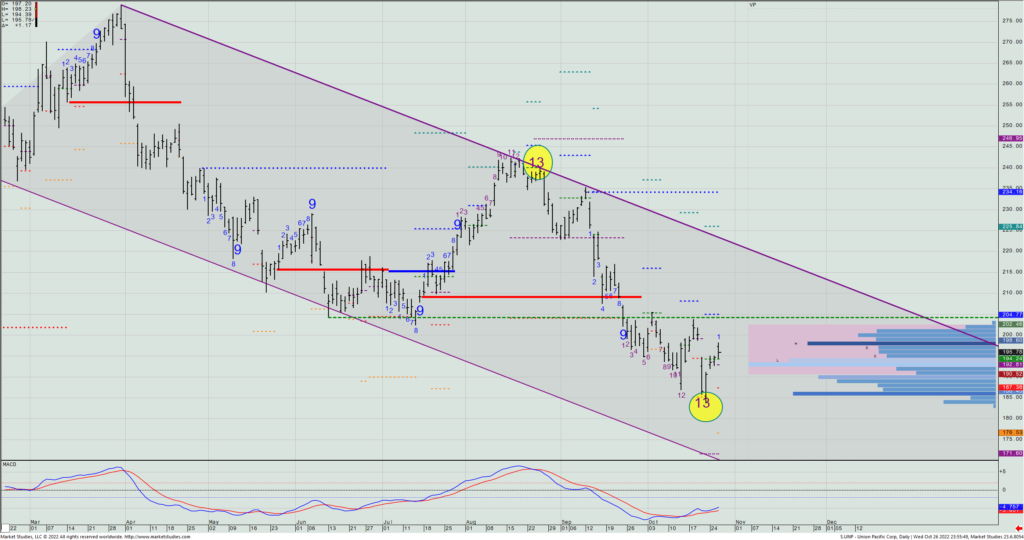

A new idea for today is to look to get long UNP Nov. 18th $197.5/$2.125 call spreads. Firstly, they reported earnings last week, so that’s not an issue we need to deal with over the next month. Secondly, the chart shows an Aggressive Sequential -13 signal on the lowest close day of the year (last week), and it’s been straight up since then. This spread closed yesterday at $4.38 mid, and is about $1.75 OTM to the lower call strike we’d be buying, making the current 29% differential paid between strikes theoretically cost a bit more because of the OTM strike. (I had actually preferred to sell the $195/$185 put spread, but they collect only 30% of the strike differential – making them priced far too cheaply for me to want to be a seller of them.)

UNP – Daily

GILD Bullish Opening Trade Signal Investment Rationale...

Read More

NVDA Bullish Opening Trade Signal Investment Rationale...

Read More

TTWO Bearish Opening Trade Signal Investment Rationale...

Read More

Share this on