DailyPlay – Portfolio Review – December 08, 2025

DailyPlay Portfolio Review Our Trades FDX – 25 DTE...

Read MoreDailyPlay Portfolio Review

Our Trades

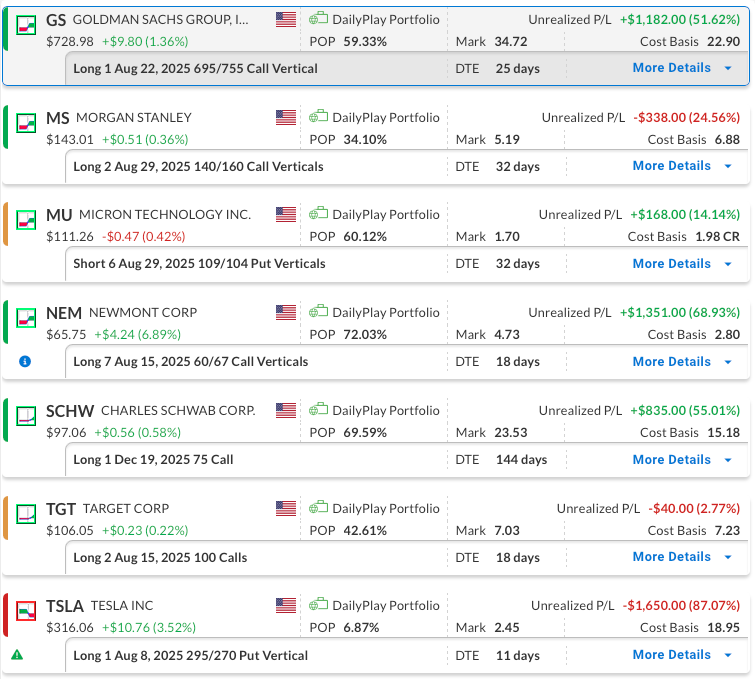

GS – 25 DTE

Bullish Debit Spread – Goldman Sachs Group, Inc. (GS) – The position is showing a solid gain following Goldman Sachs’ strong earnings report. The stock continues to trend higher and is currently trading above all major moving averages, with the 20-day MA acting as short-term support. With decent time remaining until expiration, we plan to continue holding the trade.

MS – 32 DTE

Bullish Debit Spread – Morgan Stanley (MS) – Similar to GS, Morgan Stanley delivered a solid quarterly earnings report. However, the stock sold off afterward, and the position is showing a slight loss. With time remaining until expiration, we plan to continue holding the position for now.

MU – 32 DTE

Bullish Debit Spread – Micron Technology, Inc. (MU) – The position has a slight gain as MU holds above its 50-day moving average following a pullback from recent highs. The longer-term bullish trend is building after a period of consolidation, with the stock maintaining higher lows and trading above both the 200-day and 50-day MAs. We plan to continue holding the trade with plenty of time remaining until expiration

NEM – 18 DTE

Bullish Debit Spread – Newmont Corporation (NEM) – The position is showing a solid gain following the company’s earnings report. NEM broke out to new 52-week highs with strong volume, confirming bullish momentum. The stock is trading well above its key moving averages, and the RSI remains elevated, indicating continued strength. In its earnings release, Newmont Corporation (NYSE:NEM) said net income attributable to shareholders in the second quarter of the year jumped by 142 percent. We plan to continue holding with time remaining until expiration.

SCHW – 144 DTE

Bullish Long Call – Charles Schwab Corp. (SCHW) – We maintain a positive outlook, driven by solid company fundamentals and ongoing strength across SCHW and the broader financial sector. The company reported solid earnings, and the stock made a strong upside move following the announcement. We will stay the course for now.

TGT – 18 DTE

Bullish Long Call – Target Corporation (TGT) – The trade is currently unchanged. After clearing resistance at 100, the stock moved sideways for a period, then broke out above the 106 level last week. Given the time left until expiration, we will continue to hold the position

TSLA – 11 DTE

Bearish Debit Spread – Tesla, Inc. (TSLA) – The position is currently down, though we’ve improved our overall risk profile by rolling the short leg for a gain and collecting a net credit. TSLA is trading in a narrow range with low volume, likely in anticipation of post-earnings movement. With the earnings report now behind us, we’ll maintain the position and continue monitoring price action closely as we evaluate the next steps.

DailyPlay Portfolio Review Our Trades FDX – 25 DTE...

Read More

MU Bullish Opening Trade Signal Investment Rationale...

Read More

NVDA Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on