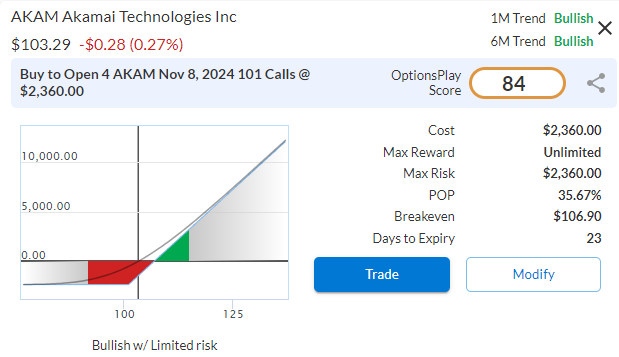

DailyPlay – Opening Trade (AKAM) – October 16, 2024

AKAM Bullish Opening Trade Signal

Investment Rationale

Akamai Technologies (AKAM) recently broke out above its $102.50 resistance level, with a potential target of $125. The chart shows a long period of underperformance, followed by a bottoming formation, and now it appears to be breaking out. While often overlooked, Akamai’s edge computing servers are well-suited for AI applications, offering faster service and enhanced security. Despite trading at a discount, Akamai’s technology could play a crucial role in AI deployment, potentially driving future revenue growth. With the upcoming Earnings Date on Thursday November 7th, we will use the potential implied volatility increase caused by this known event in our strategy choice.

AKAM – Daily

Trade Details

Strategy Details

Strategy: Long Call

Direction: Bullish Calls

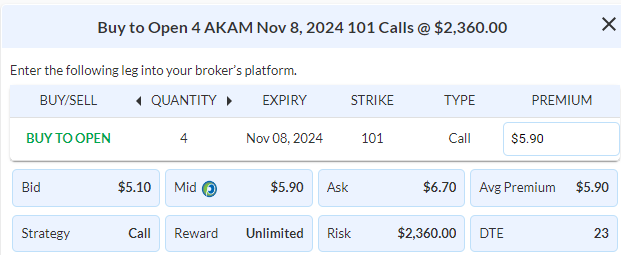

Details: Buy to Open 4 AKAM Nov 8 $101 Calls @ $5.90 Debit per Contract.

Total Risk: This trade has a max risk of $2,360 (4 Contracts x $590) based on a hypothetical $100,000 portfolio risking 2%. We suggest using 2% of your portfolio value and divide it by $590 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher off recent support.

1M/6M Trends: Bullish/Bullish

Relative Strength: 5/10

OptionsPlay Score: 84

Stop Loss: @ $2.95 (50% loss of premium)

View AKAM Trade

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View AKAM Trade

More DailyPlay

DailyPlay – Adjusting Trade (AAPL) – June 26, 2025

AAPL Bearish Trade Adjustment Signal Investment...

Read More

DailyPlay – Opening Trade (MU) – June 25, 2025

MU Bullish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Opening Trade (GOOGL) & Closing Trade (MU) – June 24, 2025

Closing Trade GOOGL Bullish Opening Trade Signal Investment...

Read More

Share this on