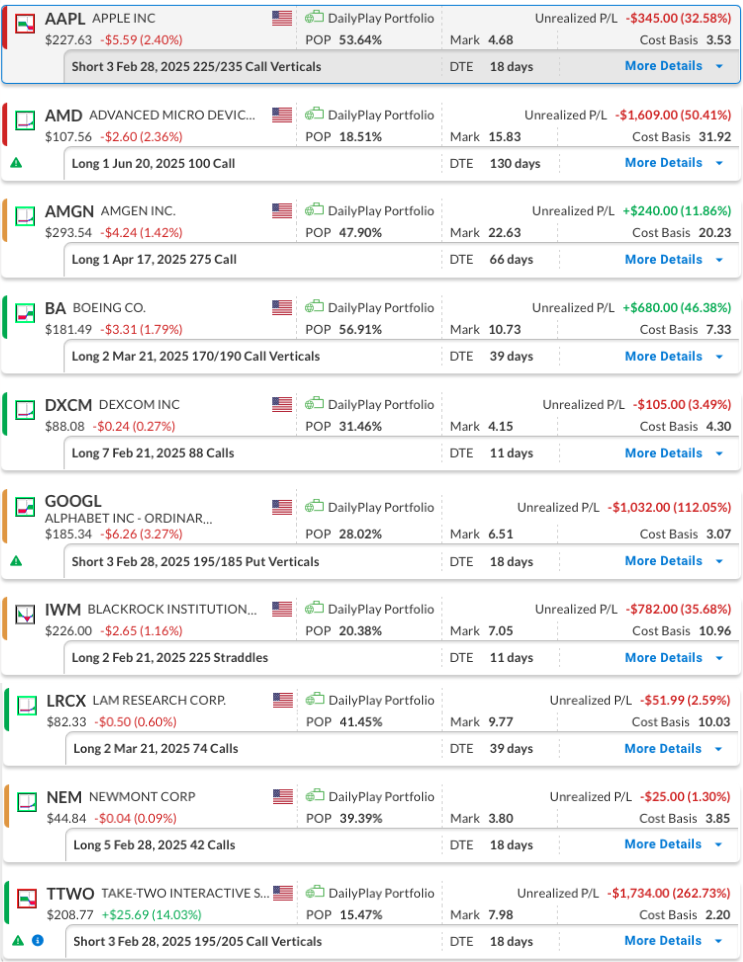

DailyPlay – Portfolio Review – February 10, 2025

DailyPlay Portfolio Review

Our Trades

AAPL – 18 DTE

Bearish Credit Spread – Apple Inc. (AAPL) – The position is at a loss, but once again, the stock showed some weakness into the close on Friday. This weakness has been helpful for the position, and with considerable time remaining until expiration, no immediate action is planned. We are maintaining a tight watch.

AMD – 130 DTE

Bullish Long Call – Advanced Micro Devices, Inc. (AMD) – The position remains down, and last week’s earnings announcement didn’t provide the boost we had hoped for. While we’re not pulling the plug just yet, we’re keeping a close watch. There’s still plenty of time until the expiration of the option, but we’re ready to move quickly if the situation calls for it.

AMGN – 66 DTE

Bullish Long Call – Amgen Inc. (AMGN) – We just established this position, and the company announced earnings this week. The stock price has been volatile since the announcement, but the position is currently showing a gain, so we plan to stay the course for now.

BA – 39 DTE

Bullish Debit Spread – The Boeing Company (BA) – We are up on this position, the stock has been range-bound since the earnings release. We still have plenty of time left in the option contracts and plan to stay the course for now.

DXCM – 11 DTE

Bullish Diagonal Spread – DexCom, Inc. (DXCM) – Our Bullish Diagonal Spread has now become a Bullish Long Call position. The shorter-term short option contract expired worthless this week, which has benefited the position, and we currently have a gain. The company is set to announce earnings after market close on Thursday, February 13, and we will need to decide on one of three actions: sell to close before earnings, hold through the earnings report as is, or sell another option contract to convert this into a bull call vertical spread ahead of the event.

GOOGL – 18 DTE

Bullish Credit Spread – Alphabet Inc. (GOOGL) – The company announced earnings this week, and the stock price took a hit, primarily due to Alphabet’s announcement during the conference call that it plans to significantly increase spending on AI. The position is down, and we will need to monitor it closely at the start of the week.

IWM – 11 DTE

Sharp Move Straddle – iShares Russell 2000 ETF (IWM) – We are down a bit on the position. We plan to hold steady for now, keeping a close eye as time value decays with the February 21 option contract expiration approaching.

LRCX – 39 DTE

Bullish Long Call – Lam Research Corporation (LRCX) – We recently established this position and plan to stay the course for now.

NEM – 18 DTE

Bullish Long Call – Newmont Corporation (NEM) – We recently established this position and plan to stay the course for now. Be aware that there is an earnings call on Thursday February 20th which is prior to the expiration of the option contract.

TTWO – 18 DTE

Bearish Credit Spread – Take-Two Interactive Software, Inc. (TTWO) – The company announced earnings this week, and the stock price jumped, erasing the gains in the position. We will keep a close watch at the beginning of the week and stand ready to close the position if needed.

More DailyPlay

DailyPlay – Opening Trade (GLD) – September 18, 2025

GLD Bearish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Opening Trade (PM) – September 17, 2025

PM Bearish Opening Trade Signal Investment Rationale...

Read More

DailyPlay – Opening Trade (C) – September 16, 2025

C Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on