DailyPlay – Opening Trade (CRWD) – August 06, 2025

CRWD Bearish Opening Trade Signal Investment Rationale...

Read MoreInvestment Thesis

Micron Technology (MU) presents a high-conviction bullish setup heading into its earnings report today, Wednesday June 25th, with the options market pricing an 8.11% expected move. Micron is mentioned in the earnings navigator section at the end of this week’s trade ideas research report, reflecting its prominence as a top earnings catalyst this week. The stock is benefitting from a powerful convergence of secular tailwinds and earnings momentum, particularly tied to the AI-driven demand for high-performance memory. As one of the best-positioned plays in the DRAM and NAND recovery cycle, MU stands to outperform in the second half of 2025. A strong earnings beat and guide could drive further institutional accumulation, especially given its deep relative valuation discount and surging growth profile. The setup is attractive both as a short-term catalyst trade and a longer-term structural long.

Technical Analysis:

MU has decisively broken out above the $110 resistance zone and is now trading at multi-year highs, closing at $127.91. Price action remains bullish, supported by a steepening trendline that has developed since April. The stock is trading well above its 20-, 50-, and 200-day moving averages, all of which are trending higher. Volume trends also indicate accumulation, adding conviction to the breakout ahead of earnings. One potential concern is the RSI, which has reached 83, suggesting the stock may be approaching overbought territory. However, there is still some opportunity for further upside if the earnings report is perceived positively by the market, with our upside target at $135.

Fundamental Analysis:

Micron remains one of the most attractive names in the semiconductor space on a valuation-adjusted growth basis, with AI tailwinds accelerating demand for next-gen memory products. Industry dynamics are improving, and Micron is expected to deliver a notable earnings inflection as pricing recovers.

Options Trade:

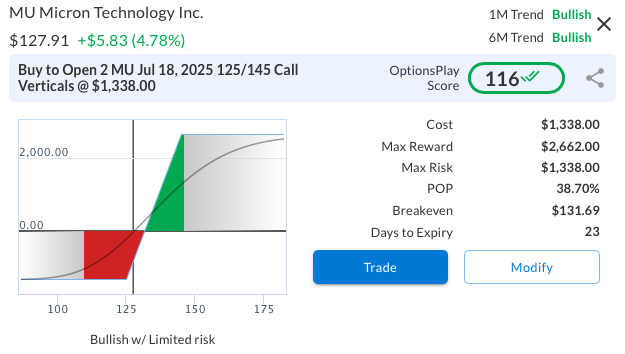

A bullish call vertical is favored into earnings: Buy the MU Jul 18, 2025 125/145 Call Spread for $6.69. This trade risks $669 to potentially make $1,331 (2.0x reward-to-risk ratio) if MU closes above $145 by expiration. With 24 days to expiry, this structure captures the earnings event while capping downside versus outright calls. The 125 strike sits just in-the-money, while the 145 target aligns with a post-earnings extension consistent with the implied move and current momentum. This trade expresses a directional bullish view while maintaining defined risk.

Strategy: Long Call Vertical Spread

Direction: Bullish Debit Spread

Details: Buy to Open 2 MU July 18 $125/$145 Call Vertical Spreads @ $6.69 Debit per Contract.

Total Risk: This trade has a max risk of $1,338 (2 Contracts x $669) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $669 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 10/10

OptionsPlay Score: 116

Stop Loss: @ $3.35 (50% loss of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Tuesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

CRWD Bearish Opening Trade Signal Investment Rationale...

Read More

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read More

DailyPlay Portfolio Review Our Trades FSLR – 11 DTE...

Read More

MS Bullish Trade Adjustment Signal Investment Rationale...

Read More

Share this on