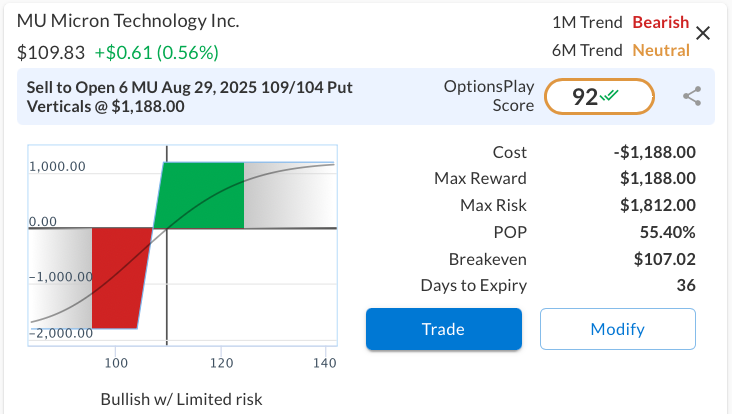

DailyPlay – Opening Trade (MU) – July 24, 2025

MU Bullish Opening Trade Signal

Investment Rationale

Investment Thesis

Micron Technology (MU) presents a compelling bullish opportunity as a leading semiconductor name poised to benefit from AI-driven memory demand and cyclical recovery in DRAM and NAND pricing. Despite recent macro uncertainty, the stock’s strong relative performance, discounted valuation, and robust growth profile set the stage for continued upside. With shares showing notable strength versus peers and broader markets, MU looks well-positioned to retest prior highs and potentially push toward the $135 level over the coming months.

Technical Analysis

MU recently broke out of a multi-month consolidation range on rising volume and strong momentum, clearing key resistance at the $115 level. The stock is now consolidating just above prior breakout levels and near short-term moving averages, with support developing around 50-day MA near $109. RSI remains neutral near 40, leaving room for renewed upside momentum. The intermediate-term trend remains bullish, with price action well-supported above a rising 200-day MA at $98. A confirmed move through $120 would likely open the door to a continued advance toward the $135 target zone.

Fundamental Analysis

Micron remains substantially undervalued relative to its peers despite sector-leading growth expectations and improving profitability outlook. The company’s long-term investment in high-bandwidth memory and AI-related infrastructure continues to support its revenue pipeline and margin expansion potential.

- Forward PE Ratio: 9.41x vs. Industry Median 27.83x

- Expected EPS Growth: 105.94% vs. Industry Median 18.05%

- Expected Revenue Growth: 26.78% vs. Industry Median 10.44%

- Net Margins: 18.41% vs. Industry Median 10.43%

Options Trade

To express a bullish view with defined risk, consider selling the MU Aug 29, 2025 109/104 Put Vertical for a $1.98 credit. This trade generates a maximum profit of $198 if MU stays above $109 through expiration, with a maximum risk of $302 if shares close below $104. The 36-day duration provides a favorable balance between time decay and directional exposure. Given strong support near $109 and overall bullish structure, this short put vertical allows traders to benefit from bullish consolidation while keeping risk limited and probabilities skewed in their favor.

MU – Daily

Trade Details

Strategy Details

Strategy: Short Put Vertical Spread

Direction: Bullish Credit Spread

Details: Sell to Open 6 MU Aug 29, 2025 109/104 Put Verticals @ $1.98 Credit per Contract.

Total Risk: This trade has a max risk of $1,812 (6 Contracts x $302) based on a hypothetical $100k portfolio risking 2%. We suggest risking only 2% of the value of your portfolio and divide it by $302 to select the # contracts for your portfolio.

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of this trade.

1M/6M Trends: Bearish/Neutral

Relative Strength: 4/10

OptionsPlay Score: 92

Stop Loss: @ $3.96 (100% loss of premium)

View MU Trade

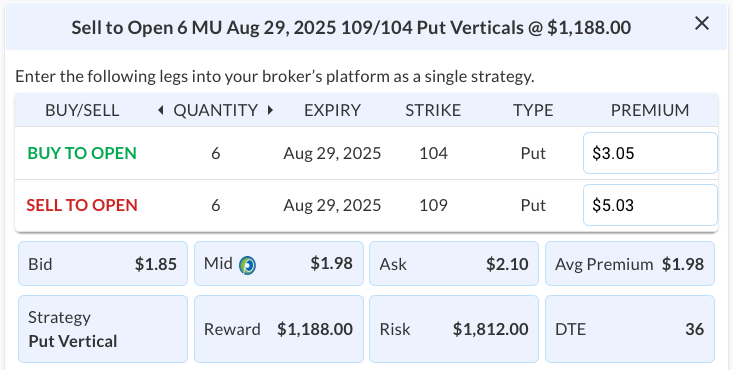

Entering the Trade

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Wednesday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

View MU Trade

More DailyPlay

DailyPlay – Opening Trade (FDX) & Closing Trade (LMT) – November 25, 2025

Closing Trade FDX Bullish Opening Trade Signal Investment...

Read More

DailyPlay – Portfolio Review – November 24, 2025

DailyPlay Portfolio Review Our Trades LMT – 11 DTE...

Read More

DailyPlay – Opening Trade (META) & Closing Trade (WMT) – November 21, 2025

Closing Trade META Bullish Opening Trade Signal Investment...

Read More

Share this on