DailyPlay – Portfolio Review – December 08, 2025

DailyPlay Portfolio Review Our Trades FDX – 25 DTE...

Read MoreAdjustment Rationale:

Our bullish outlook on Morgan Stanley (MS) remains intact, as the stock continues to trade above key moving averages following a strong rebound from recent lows. After a strong breakout to the upside at the end of June, MS has entered a tight consolidation phase near its highs, reflecting constructive price action. The RSI remains neutral, leaving room for further upside without signaling overbought conditions.

With about a month until option expiration, we recommend rolling the short leg of the spread to a lower strike within the same cycle for a net credit. This adjustment aligns with the bullish thesis while helping to manage risk and reduce downside exposure amid a modest pullback. It does, however, cap upside potential if MS breaks out decisively.

Adjustment Trade

MS @ $142.46

Days to Expiration (DTE): 28

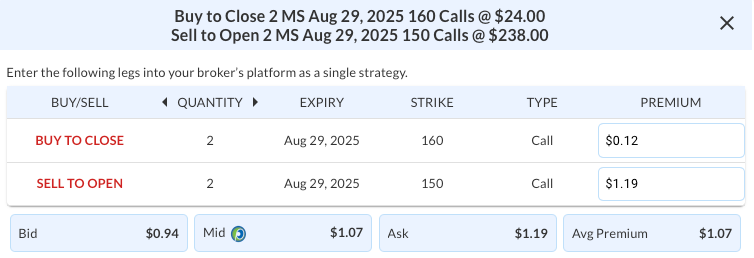

Buy to Close 2 MS Aug 29, 2025 160 Calls @ $0.12

Sell to Open 2 MS Aug 29, 2025 150 Calls @ $1.19

Mid $1.07

Premium Received: $1.07 net credit

or $214 for the adjustment trade

Strategy: Rolling a Short Call option down in strike

Direction: Resulting in a new Bullish Debit Spread

Details: Buy to Close 2 MS Aug 29 $160 Calls @ $0.12 and Sell to Open 2 MS Aug 29 $150 Calls @ $1.19

Total Risk: The resulting position has a maximum risk of $1,162 (1,376-214), calculated as the initial cost basis of the spread purchased ($1,162) minus the premium received from the adjustment ($214)

Trend Continuation Signal: This is a bullish trade on a stock that is expected to continue higher over the duration of the trade.

1M/6M Trends: Bullish/Bullish

Relative Strength: 7/10

Stop Loss: @ $2.91 (50% loss of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Thursday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

DailyPlay Portfolio Review Our Trades FDX – 25 DTE...

Read More

MU Bullish Opening Trade Signal Investment Rationale...

Read More

NVDA Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on