DailyPlay – Opening Trade (PINS) & Closing Trade (TGT, NEM) – August 05, 2025

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read More

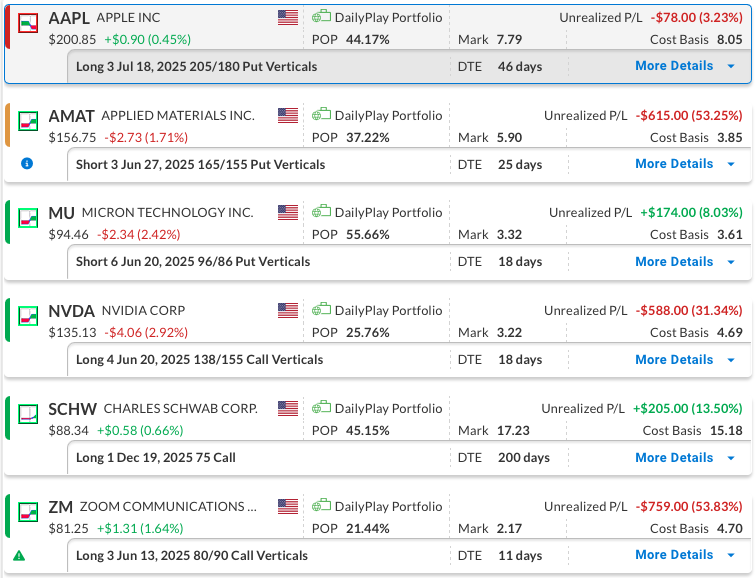

Bearish Debit Spread – Apple Inc. (AAPL) – This trade has hovered around breakeven, fluctuating between modest gains and losses. Apple remains priced at a premium compared to its peers and continues to deal with unresolved concerns around the trade war and tariffs. With ample time left until expiration, we will continue to hold the position.

Bullish Credit Spread – Applied Materials Inc. (AMAT) – The company’s fundamentals remain strong, even as the semiconductor sector struggles to gain upward traction. The position is down, but we plan to hold steady at this point.

Bullish Credit Spread – Micron Technology Inc. (MU) – Our recently opened position shows a small profit at this stage. With Micron benefiting from growing demand for memory products and a solid outlook in semiconductor supply chains, we remain committed to holding the trade.

Bullish Debit Spread – Nvidia Corp. (NVDA) – Nvidia delivered a strong earnings report with solid guidance, initially pushing the stock higher. However, those gains have since faded as shifting headlines continue to weigh on sentiment. The company’s fundamentals and demand outlook remain intact, so we’re holding the position for now.

Bullish Long Call – Charles Schwab Corp. (SCHW) – Our outlook remains positive, supported by strong company fundamentals and continued strength in both SCHW and the broader financial sector.

Bullish Debit Spread – Zoom Communications Inc. (ZM) – In the last earnings report, Zoom beat estimates on both revenue and profit. Despite the solid results, the stock moved lower following the announcement. We finally saw some encouraging bullish movement at the end of last week and will remain in the trade for now, though time to expiration is quickly running out.

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read More

DailyPlay Portfolio Review Our Trades FSLR – 11 DTE...

Read More

MS Bullish Trade Adjustment Signal Investment Rationale...

Read More

SCHW Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on