DailyPlay – Opening Trade (PINS) & Closing Trade (TGT, NEM) – August 05, 2025

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read MoreAdjustment Rationale:

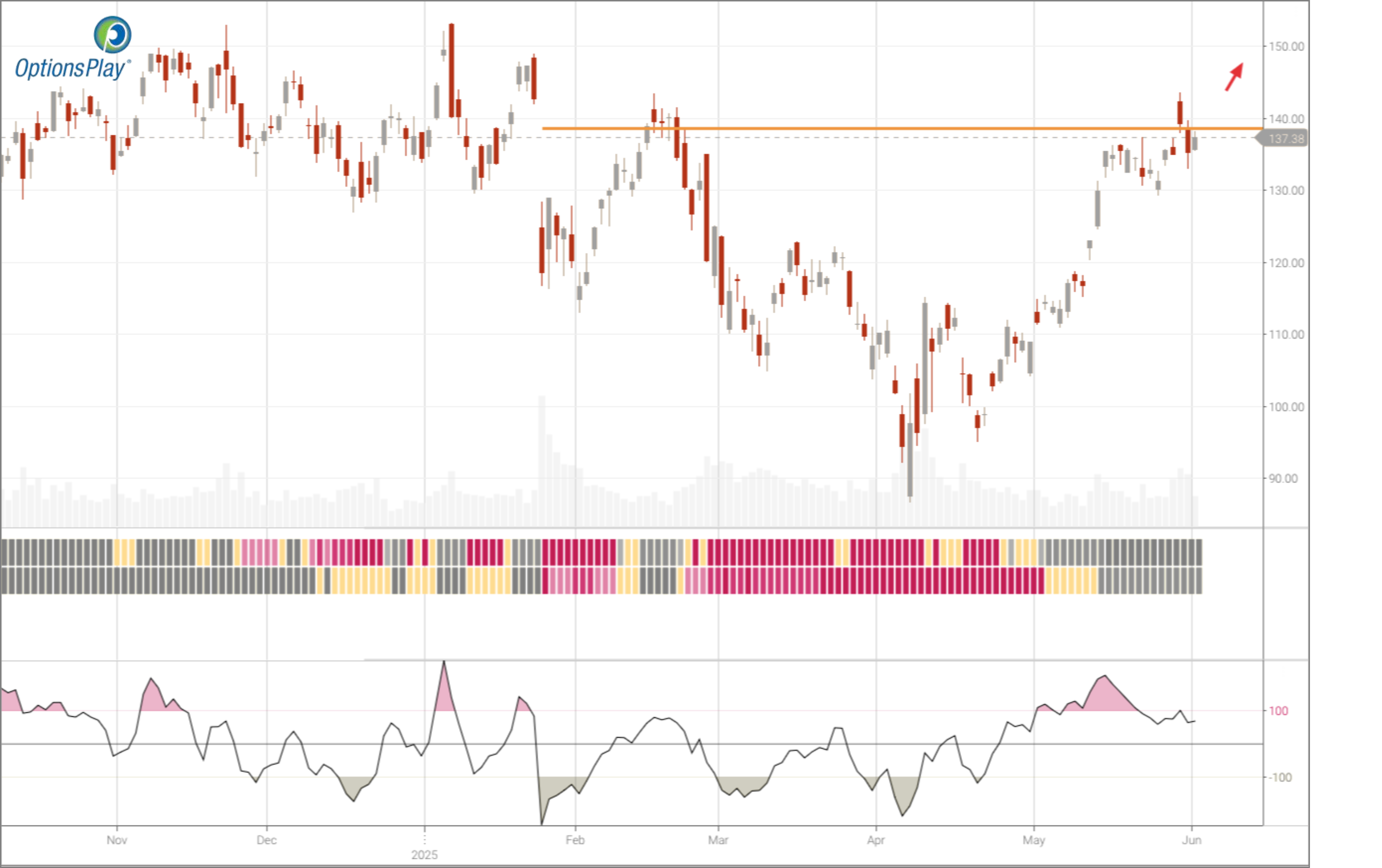

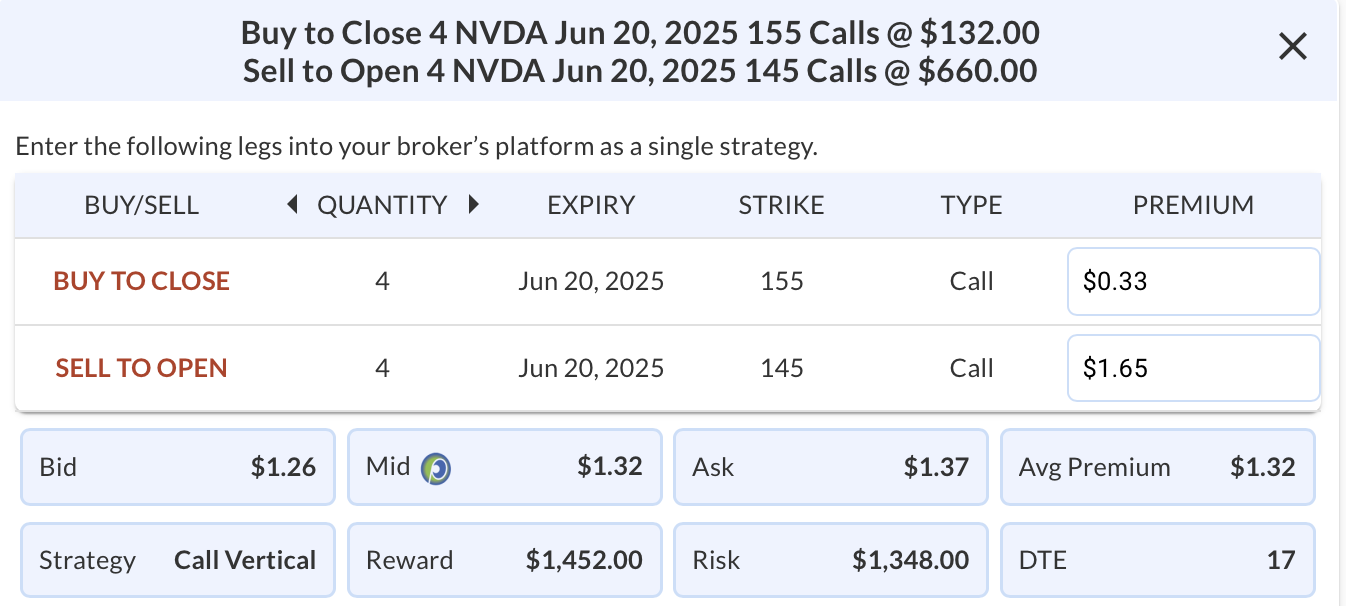

We remain bullish on NVIDIA Corp. (NVDA) and continue to hold four NVDA June 20, 2025, 138/155 bull call vertical spreads in the Daily Play portfolio. NVDA recently announced earnings. The company’s strong earnings and guidance initially drove the stock higher, though the rally has stalled amid shifting market headlines. While the fundamentals remain strong and demand for semiconductor chips is solid, the position is currently at a slight loss. With the earnings catalyst behind us, we are reducing risk by rolling the short 155 calls down to the 145 strike, same expiration, collecting a net credit on the adjustment.

Adjustment Trade

Days to Expiration (DTE): 17

Buy to Close 4 NVDA Jun 20, 2025 155 Calls @ $0.33

Sell to Open 4 NVDA Jun 20, 2025 145 Calls @ $1.65

Mid: $1.32

Average Premium Received: $1.32 net credit

or $528 (400 x $1.32) for the adjustment trade

Strategy: Rolling a Short Call option down in strike

Direction: Resulting in a new Bullish Call Vertical Spread

Details: Buy to Close 4 NVDA Jun 20, 2025 155 Calls and Sell to Open 4 NVDA Jun 20, 2025 145 Calls @ $1.32

Total Risk: The resulting position has a maximum risk of $1,348 (1,876 – 528), calculated as the initial cost basis of the four spreads purchased ($1,876) minus the premium received from the adjustment ($528).

Trend Continuation Signal: This is a bullish trade on a stock that is expected to break out above its current trading range.

1M/6M Trends: Bullish/Bullish

Relative Strength: 9/10

Stop Loss: @ $1.69(50% loss of premium)

Use the following details to enter the trade on your trading platform. Please note that whenever there is a multi-leg option strategy, it should be entered as a single trade.

PLEASE NOTE that these prices are based on Monday’s closing prices. Should the underlying move significantly during the pre-market hours, we will likely adjust the strikes and prices to reflect a more accurate trade entry.

Closing Trade PINS Bullish Opening Trade Signal Investment...

Read More

DailyPlay Portfolio Review Our Trades FSLR – 11 DTE...

Read More

MS Bullish Trade Adjustment Signal Investment Rationale...

Read More

SCHW Bullish Opening Trade Signal Investment Rationale...

Read More

Share this on